With an estimated insured loss of EUR4.5bn-EUR5.5bn ($5.35bn-$6.54bn) for Germany alone, the flooding is shaping up to be a significant event that, whilst not as costly as a mid-sized North Atlantic hurricane, nevertheless adds to a list of recent multi-billion-Euro losses that threaten the view that Europe is a generally “cat-free” zone.

With the flood event presenting some surprise aspects to underwriters, following upon shock pandemic losses, Bernd is expected to enable reinsurers to drive further pricing corrections on a localised basis, at least.

Low-pressure area Bernd: A black swan?

As revealed by this publication days after the flooding struck, the insured loss in Germany alone is likely to be at least EUR5bn. While the final loss quantum is not yet known, it is likely that losses in Belgium, France, Luxembourg and the Netherlands will push the final figure higher.

A reinsurance source presented the flooding of the German river Ahr as a “black swan” event compared with historic flooding patterns.

While the Rhine and the Elbe have both flooded in recent years, including during the infamous 2002 German floods, the Ahr reached unforeseen highs during this instance of flooding, taking many by surprise.

“These are flooding events of a different magnitude,” they said.

Much of the analysis has so far focused on the loss of life and damage to residential properties, but sources said there is also a fair amount of commercial and industrial property damage, including to wineries in the Ahr region. This too could drive up the final loss quantum, particularly because flooding can lead to large BI claims as insureds are forced to shut down while they dry out and rebuild their operations.

Historical comparisons

Sources expect to see a similar dynamic of rating pressure to that which emerged after the 2013 German flooding, which caused $3.6bn in insured losses and allowed reinsurers to press for rate increases, at least at the country-specific level.

It is clear at this point that many European and particularly German carriers will book a loss from the flooding that triggers their reinsurance programmes.

Allianz, for instance, this week disclosed that it expects to book a EUR500mn loss in Germany for damage from the flooding.

The carrier buys a “supercat” reinsurance cover that provides up to EUR1.6bn in coverage excess EUR300mn, and the carrier will therefore be passing some of its flooding loss onto the reinsurance market.

A reinsurance source said they were working on the assumption, based on where many European cedants’ programmes attach, that insurers would retain around EUR1.5bn of the flood losses, passing on the additional EUR4bn to reinsurers.

It is important to look at the floods in the context of an already fairly heavy year for losses.

Storms that struck the Czech Republic, Switzerland, Austria and Germany in June have already caused EUR4.5bn in insured losses, according to Aon.

That takes the European nat-cat load to EUR10bn already, before any winter storms arise in the autumn 2021 to spring 2022 season.

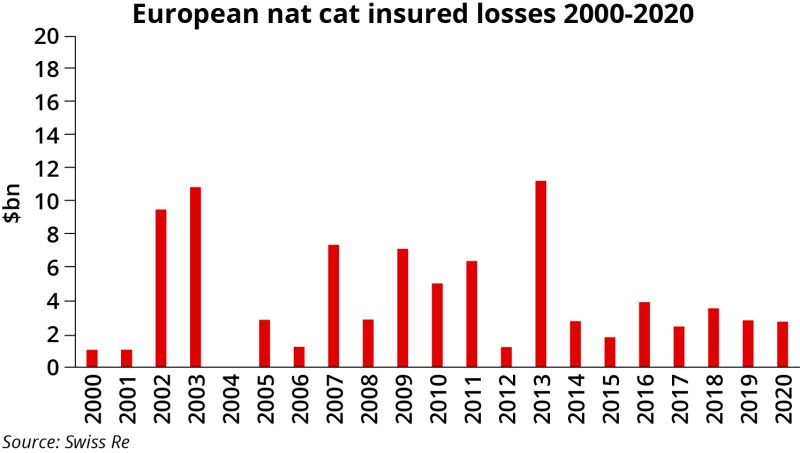

This would put 2021 among the most expensive European nat-cat years in the past two decades.

As well as the unusually high losses from natural disasters so far this year, the floods come in the context of a year of dealing with complex pandemic claims.

Despite initial confusion over the scale of original Covid-19 losses and how these would translate into reinsurance events, sources said that now, with major court decisions in the French, UK and German courts, there is much more clarity around the Covid burden reinsurers will bear.

Scor, for instance, revealed in its Q2 earnings update that it had booked an additional $109mn in Covid-19 claims during the period following the outcome of legal action in the UK and France.

Last year’s uncertainty meant that reinsurers could secure rate increases on European property contracts at 1 January with the understanding that further increases could follow the next year if the picture of Covid losses changed.

The historic levels of flooding and storm damage so far this year will only add to the pricing momentum built up by Covid-19, sources said.

Differentiated pressure and diversifying power

Sources sounded a note of caution when looking ahead to potential rate increases at the next round of renewals, however.

While there is a clear impetus from reinsurers to seek price increases, the flooding will not bring about price increases across the board but will have an impact on pricing in the worst-affected regions, such as Germany and Belgium, sources predicted.

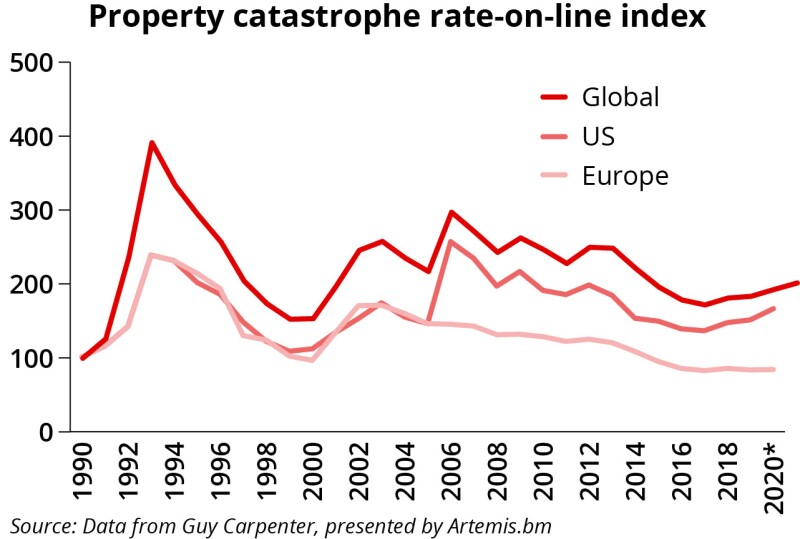

Europe has also long defied the pricing patterns of other regions during periods of hardening, often lagging notably behind other markets.

A key reason for this is global reinsurers’ use of Europe as a diversifier that helps to balance their portfolios, countering risks in peak cat zones such as the US and Japan.

Theoretically, reinsurers have been happy to continue to write European business for rates that have been soft for around two decades because despite significant attritional losses, the region does not experience cat losses at the same frequency or on the same scale as elsewhere in the world.

The last major industry loss that got the industry debating the value of taking on low-margin or below-cost diversifying business – aka “diworsification” – came after the international earthquakes and Thai flood losses of 2011.

Those disasters were each more of a shock loss than the Bernd storm, which is not out of line with expectations of a major European flood loss.

However, as the table below shows, European events exceeding $3bn or even $4bn of industry losses are not uncommon, having occurred six times in the past 20 years – or roughly once every three years.

The recent heavy cat load, as well as attritional losses, may begin to force some reinsurers to reconsider the price at which they are comfortable with writing European business.