Wheeler said that all Mosaic’s prospective clients “really want syndication” and explained that the business’s model was built on the idea of disseminating the advantages of Lloyd’s worldwide, which have typically only been accessible via the London market.

The executive made the comments in an interview with Insurance Insider following his long-rumoured appointment as co-CEO of Mosaic, a move which reunites him with former Ironshore colleague Mitch Blaser.

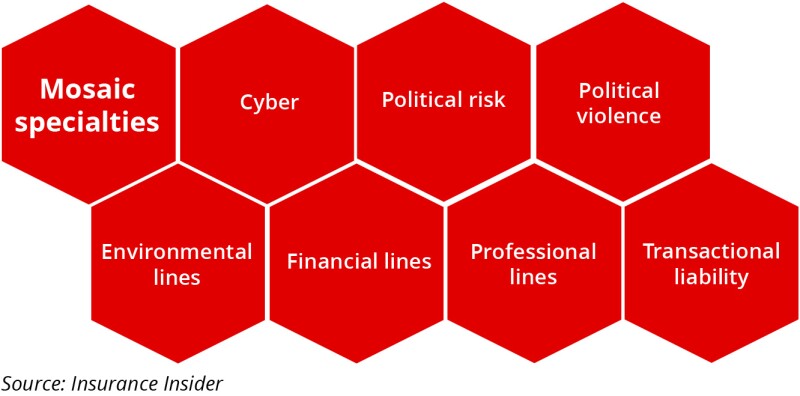

Mosaic was launched in February and will focus on a number of specialist lines – transactional liability, cyber, political risk, political violence, environmental, financial and professional lines. These will be written on the paper of Syndicate 1609, which will be the firm’s unified capital base and provide the necessary licensing. Business will be accessed via underwriting hubs including Bermuda, Asia and the US, with risk shared with other carriers via MGA relationships.

Its model has been dubbed “eating our own cooking” by co-CEO Mitch Blaser, referring to Mosaic’s commitment to take the lead line on every risk it writes, while combining local coverage with global distribution capabilities.

Wheeler cited Lloyd’s declining market share in marine business, which stood at 50% after the Second World War but is now around 8%, as evidence of the need to export the syndicated model across the globe.

“Lloyd’s is still a massive player in marine, but it is not the eminent force it was, and if you are going to stay in London, you aren’t going to get it,” he said.

Wheeler acknowledged it was an “extreme example”, but said there were now talent, resources and billions of dollars of capacity in locations including Singapore, Miami and Dubai.

“Why not take the advantages of Lloyd’s and export them to those places?” Wheeler said.

“And that really fitted in with our notion of the value of syndication. All of our clients, and particularly in these lines, really want syndication and that is one of the main reasons.

“You might have a risk manager who likes to go to Harrods, likes to go to the Ivy, you might have one who wants to go to London Zoo. But they are there to get a syndicated product when all is said and done; it’s not to bask in our glorified intellect and charm.”

Mosaic has assembled a team of senior underwriters for its launch, amongst them former Pembroke and Ironshore colleagues, such as Quentin Prebble, who leads the war, terrorism and political violence team.

Wheeler and Blaser are themselves friends and former Ironshore colleagues, but Wheeler insisted that Mosaic was not “just about getting the band back on the road again”.

“Ironshore is a really great model, and it still is a well-respected specialty franchise,” Wheeler said.

“But Mosaic is going to take some of the most successful aspects of that model and then do things differently.”

Blaser added that he and Wheeler had been a “great team for a long time”, were aligned in strategic thinking, and complimented each other’s skills.

Frailty eradication

Wheeler said that Mosaic was a “beautiful opportunity” because it had afforded the chance to consider all the business models that are available.

“Our approach was frailty eradication,” he explained. “Every model has a frailty. It became apparent that an agency structure meant we could navigate some of the frailties of balance-sheet businesses, particularly today, given the availability of capital and the regulations around that.”

According to Wheeler, Mosaic has “eradicated” the key frailties of an MGA structure, especially the lack of permanent capital and claims handling expertise, through its Lloyd’s syndicate and the in-house capabilities it has built.

Mosaic has a long-term capital agreement with Golden Gate Capital, which Wheeler said stemmed from a desire to “build a company that would stand the test of time”.

“We have permanence of capital, we have permanence of leadership, in particular, and that means we will control the claims product in what are long-term lines,” he said.

“An MGA writing these lines cannot honestly look a client or a broker in the eye and say, ‘I know who your lead capacity will be in seven or eight years’ time when we pay this claim’. And we can.”

Our approach was frailty eradication. Every model has a frailty

Despite its global syndication model, underwriting will be centrally controlled and underwriters will work in tandem across different locations.

“All of our underwriting will be centrally controlled, and the guy sitting at the corner of the box on the second gallery will have the same underwriting governance, framework, marching orders, appetite, reinsurance programme and PML as the guy sitting in Singapore,” Wheeler said.

Having already built a successful London market business, the executive said he was “really proud” that Mosaic had secured a syndicate in Lloyd’s. Syndicate 1609 is a reference to the date that Britons first settled on Bermuda following a shipwreck.

“We are a beneficiary of all those things and a custodian of the future [of Lloyd’s], and are really proud and happy to be so,” he said.

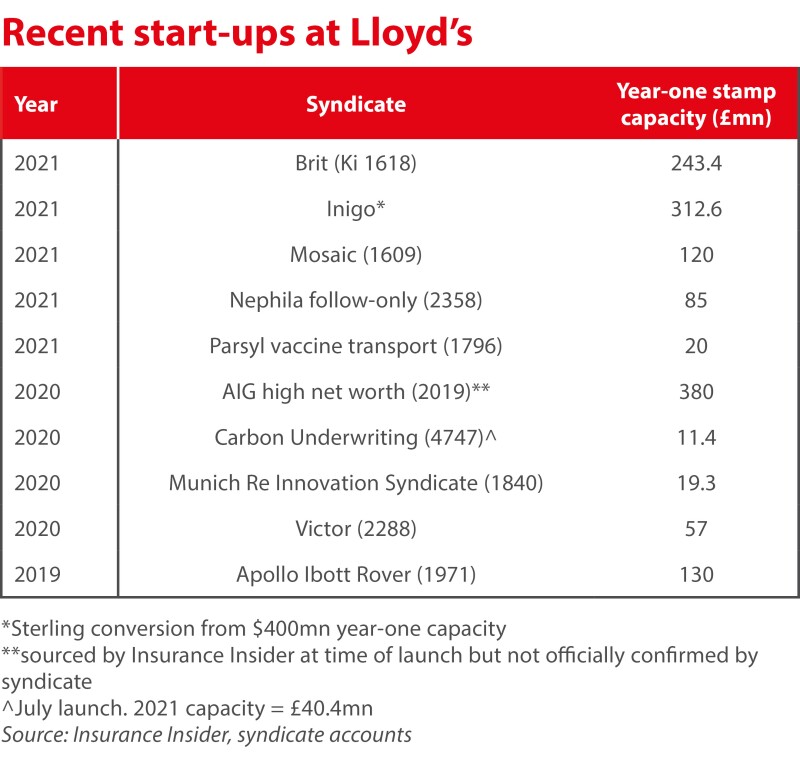

The Lloyd’s vehicle is understood to have a stamp capacity of around £120mn ($165mn).

Legacy-free opportunities

Mosaic is one of a number of start-ups to have launched amid a widespread hardening in global (re)insurance markets, which has been accelerated by the Covid-19 pandemic.

Blaser has previously explained that Mosaic was not prompted by Covid-19, and the intention of the business is to create a model that is profitable irrespective of the market cycle.

Wheeler said that “the tailwind is certainly more amplified than we expected” and added that demand for the product lines Mosaic operates in is increasing.

He explained that Mosaic’s chosen business segments were more exposed to the indirect economic fallout arising from the pandemic.

“For our lines, in particular, it’s all about the indirect Covid exposures, the recessionary ones, the impact on international trade, political violence, cyber,” Wheeler said.

He noted that it was the “first insurance cycle ever that has not been driven by a shortage of capital”.

Blaser chimed in to say that the potential impact of Covid-19 on the sector was still emerging.

“The litigation has really not even started. It’s just beginning,” he said. “That’s where I think there is a lot of unanticipated impact on legacy balance sheets.”

However, Blaser said that being a “greenfield site” in terms of technology was just as vital as not having legacy underwriting exposure.

This is the first insurance cycle ever that has not been driven by a shortage of capital

He anticipates Mosaic will trim five points off its combined ratio thanks to its business model and technological investment, once it is fully up and running.

Mosaic is developing a technology platform as part of a joint venture with a leading tech firm, which it expects in time to monetise via deals with other carriers.

“Not having legacy infrastructure has become just about as important as not having a legacy balance sheet,” Blaser commented.