Healthy reinsurance capital levels contrast with the poor financial state of local insurers, setting the scene for “a bit of a stand-off", as one underwriter phrased it.

“Underwriters still aren’t happy with the pricing and the brokers know the clients can’t go to the level the reinsurers need,” the source said. “The whole market is very fragile right now.”

Although last year’s hurricane season hit insurers harder than reinsurers with multiple retained losses, there are still market fears around continued Hurricane Irma loss creep falling to reinsurers – despite now being past the three-year statutory limit for claims to be filed.

Sources said that re-opens of cases were driving continued deterioration and while they said it was difficult to give average estimates, in some cases quarterly creep has been 5% , 10% or more above prior figures, which is still a significant level more than three years on from the storm.

ASI is among the carriers that have recently reported increased claims to its reinsurers, although the scale of uplift is not known. But as the insurer is seen as one of the stronger performers within Florida on claims management and general operations, some are concerned that its experience is a signal that its peers may face similar deterioration.

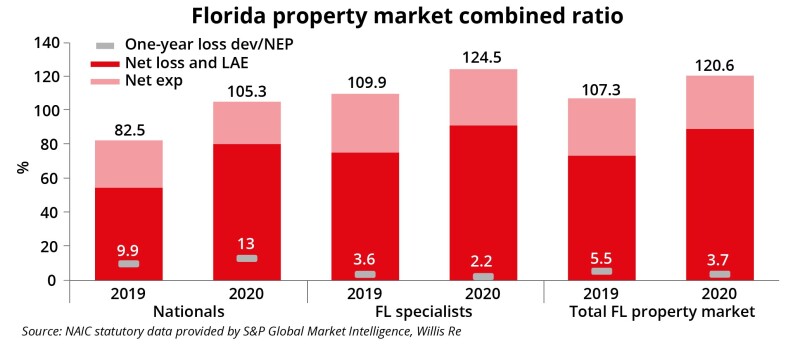

However, excess-of-loss reinsurer results from Florida have fared better in the past couple of years, and for some post-2017 profits and rate increases may make the business look more acceptable.

“Most reinsurers have already done their de-risking,” one broker said, adding that carriers were generally either looking to selectively grow into the rising market or maintaining their shares.

But while overall reinsurer appetite may be healthy, carriers are pulling back from certain pockets.

Attritional risk layers and programmes for financially troubled carriers are expected to be harder to place – continuing a theme from the past year of increasingly differentiated and variable outcomes for the state’s carriers.

The precarious situation is highlighted by the fact that Demotech has said nine carriers need to show markedly better results this year to maintain their rating; by the fact that one of the state’s largest listed carriers had to turn to a dilutive share issue to raise capital after facing significant Winter Storm Uri losses; and that the state insurer Citizens is preparing for major growth as private insurers shed policies.

The struggle is for near-term survival – but in the longer-term, the state’s insurers still face a huge danger from a majorly destructive hurricane that they could not pay for. Some insurers exhausted their private or total reinsurance programmes from Irma – a roughly $30bn storm that some modelling agencies estimated could recur every 10 years.

Reinsurer key concerns

Credit risk is top of mind, with the backdrop of the recent receivership of American Capital Assurance, and already thinly capitalised companies losing surplus due to last year’s retained hurricane claims.

This will lead to demands for more security around premium payment and changes to payment schedules, as well as higher rate demands in these cases – which the most constrained carriers might struggle to afford.

On lower layers, nominal rates-on-line are already high – from mid-30s into the 40s. But reinsurers are “tired of attritional losses”, with fewer carriers willing to support these layers, one underwriter said.

Another underwriter pointed out that regional diversification on the part of cedants has exacerbated the impact of lower-layer reinsurance losses, as programmes pick up claims from events in other southern states.

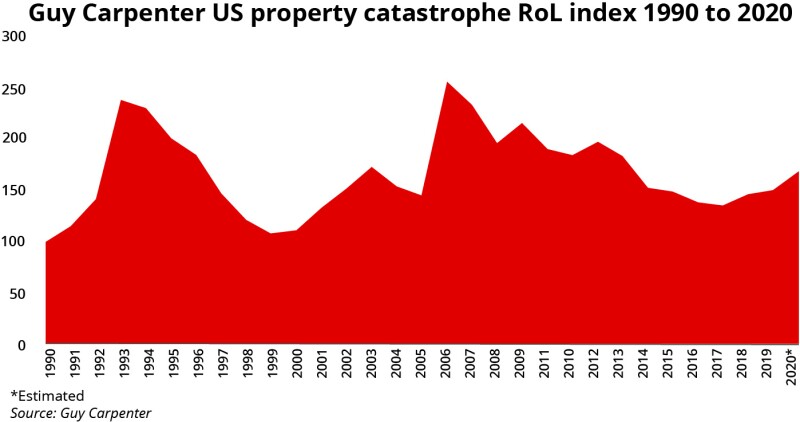

Meanwhile, although there is a sense that reinsurance market momentum has disappointed in earlier 2021 renewals, one underwriter said this would if anything firm stances heading into 1 June, with an attitude of “Florida is the area where we will catch up in rate increases.”

And while expansive carriers and new capacity may be looking for a foothold in the market, dislocated D&F and binders markets are an alternative source of growth, the underwriter suggested.

Ultimately, the renewal will be a test of whether the overall strength in reinsurance supply, and ebbing post-Covid momentum, will offset Florida-specific concerns.

Persistently high litigation and claims inflation is a major bugbear, although there are hopes this year for significant legal reform. But even though many litigated cases do not relate to catastrophe losses and thus remain with insurers, reinsurers will be concerned over whether lawsuits connected to the 2020 storms will result in a new wave of loss inflation. Meanwhile, early forecasts suggest another active season may lie ahead.

The counter-case

The wide range of private placements in last year’s renewals makes it difficult to establish a benchmark for remediation needed this year, sources said.

But reinsurers were suggesting 10%-15% increases would be seen as a minimum acceptable level, while brokers argue market dynamics mean it will struggle to clear this threshold.

In the 1 January US cat renewals, rate change was around the 10% benchmark, this publication estimated, although lower in ex-US regions and by 1 April as momentum slowed Willis Re put April US renewals flat to 10% up on loss-free business, with Japanese renewals also disappointing some.

Regardless, it is clear that Florida reinsurers are not in for another round of the level of correction that took place last year, approaching increases of 30% by the end of a renewal that got tighter as it went on.

Indeed, HSCM Bermuda partner Edouard Von Herberstein – who is now reviewing around $2bn of reinsurance buying on behalf of the firm’s ownership interests in Florida carriers – said that he believed there were multiple reasons why rates should not harden significantly this year.

He pointed to the volume of new reinsurance capital entering the market, easing of retro rate increases, and generally favourable loss experience for reinsurers during the past two storm seasons.

Florida was hit by fewer storms last year than Louisiana, and the impact was relatively focused within the panhandle area. This meant that while some carriers did transfer losses to reinsurers, there were not widespread major claims, Von Herberstein said.

Looking at loss experience does not touch on the question of whether risk models are adequate, he noted, but after 40%-55% rate increases for some cedants over the past two years, “we seem to be reaching a bit of a balance”, he said.

“There's a few things going on for insurers that will help reinsurers in the long-run,” he added, pointing to insurers that are “aggressively” de-risking their books and shrinking in litigious counties.

However, as another underwriter put it, with the backdrop of elevated litigation risk, whatever rate increases settle at this year may still leave reinsurers treading water. “Whatever the number is, it is not enough – but reinsurers know [insurers] can't afford it.”

ASI did not respond to a request for comment.