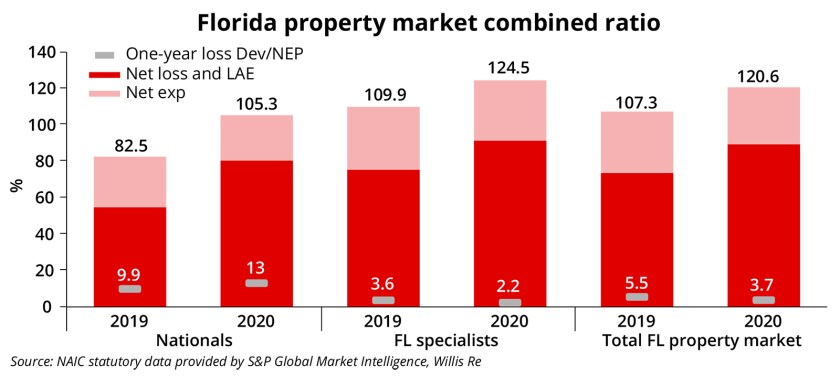

Data compiled by Willis Re on the Floridian market gives fresh confirmation that the property market in the state is severely challenged.

Combined

Data compiled by Willis Re on the Floridian market gives fresh confirmation that the property market in the state is severely challenged.

Combined