AJ Gallagher

-

He will join Gallagher as chief broking officer for EMEA transaction solutions.

-

Clive Strickland previously worked at Gallagher, where he had been a partner since 2020.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The energy broker’s career also includes a stint at Price Forbes.

-

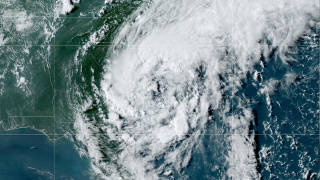

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

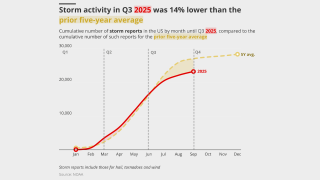

Though wildfire losses are up, total losses are the lowest since 2015.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

Plus, the latest people moves and all the top news of the week.

-

The change in reinsurance intermediary follows an RFP for the account.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

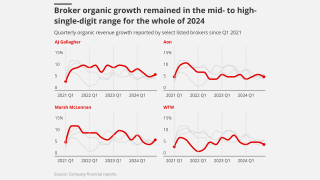

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

Alistair Lester joins from Aon, where he has worked for the past eight years.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The US accounted for 92% of all global insured losses for the period.

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The availability of capacity remains the market’s key driver, the broker said.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

This publication revealed his exit from MS Re last month.

-

Henk Bijl joins from Aon, where he has worked for the last 25 years.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Renewable retrospective solutions were a key point during the discussion.

-

Their next destination remains unknown.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The broker will be based in Oslo and drive expansion in the Nordic region.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The book of business comprises both personal and commercial lines.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Large losses and attrition put pressure on aviation underwriters.

-

Langley said the London market could benefit from boosting its image at home and abroad.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Gallagher Re’s global head of retrospective solutions, James Dickerson, recently exited.

-

The 1 April renewals are the key date for Japanese treaty.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Michael Pickel retired from Hannover Re last year after 25 years with the reinsurer.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Dickerson has spent over three years at the reinsurance broker.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

The broker’s current Australia and Asia CEO starts her new role on 1 July.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

Plus, the latest people moves and all the top news of the week.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The portfolio tracker facility is led by Canopius.

-

The executive spent 43 years with WTW before joining Gallagher through the Willis Re sale.

-

Parker has worked at Ardonagh-owned Paragon since 2012.

-

The broker added reinsurers remain cautious on US casualty risk.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

Bradley was construction team leader for US casualty at WTW.

-

Mathieu Loisel joins the reinsurance broker from New Re.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

The broker said the market had entered a ‘new normal’ after $2bn+ losses

-

The broker cautioned unresolved Russia-Ukraine claims remain a ‘Black Swan’

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

The reinsurance market is now in a healthy, stable condition, according to Gallagher Re.

-

Axa XL leads the aviation all-risks reinsurance coverage for the destroyed Jeju Air Boeing 737-800 craft.

-

Axa XL is understood to be the lead carrier, with Gallagher the broker on the account.

-

The pair will lead crisis management and financial lines, respectively.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

If the deal is finalised, it will represent the largest in the acquirer’s history.

-

The executive will also serve as an independent non-executive director of Gallagher in the UK.

-

The Pen Underwriting MGA is expanding from its marine war specialism.

-

The exits include several senior brokers who were previously with JLT and Hayward Aviation.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Samer Ahmad was with Marsh for more than seven years.

-

The broker said that pricing dynamics would require careful management, but adequacy remains

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

The pair will report to Imea CEO Julian Samengo-Turner.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

The above-average tally was driven by a high frequency of mid-sized events.

-

The cost to the NFIP is likely to be a “mid to high single-digit-billion impact”.

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The broker confirmed Darren Jones and Ian Curtin were also joining the firm.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

Simon Collings will join Gallagher’s UK executive team, reporting to UK CEO Michael Rae.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Construction rates remain stable with some talk of potential softening.

-

Former Artex managing director Jasmine DeSilva will run the segment.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

Current head of specialty Paul Upton will move to become chairman of the division.

-

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

This is a new role for the broker.

-

W&I premium rates have fallen as low as 0.4% in the UK.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The broker said rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

Most recently, Richard Harries was CEO at Atrium Underwriters.

-

David Ritchie had worked at the broker for 15 years and ran the D&O and FI teams.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

Based in Peru, the executive will oversee marine and aviation lines.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker will work to support US client retention and business growth.

-

The company said insurers’ capacity and appetite had spurred competition over Q2.

-

-

The broker said another strong year would drive pressure for “reasonably significant rate reductions” next year.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Richard Rudden left Fidelis MGU as head of energy transition in March.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.