Validus

-

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The Bermudian’s global property CUO and European chief says it is ready to expand if conditions remain favourable.

-

RenaissanceRe has said it hopes to retain as much as 90% of the Validus Re portfolio, but where are the highest areas of overlap by cedant?

-

Morgan Stanley and Golman Sachs exercised in full their right to buy 945,000 shares in the company.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

The deal is the third scale-up buyout for the firm, highlighting the ongoing value of scale in the reinsurance segment.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

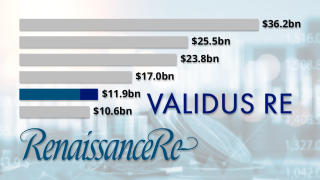

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

This came as parent AIG said it had around $6bn of reinsurance limit available for 2023.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.