-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

The broker grew earnings per share by 12.1% during the quarter.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

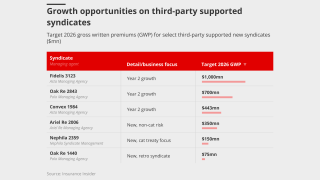

Private capital providers are being signed down as two strong years have piqued interest.

-

The London MGA is considering various options, including a minority investor.

-

The appointments are aimed at offering a clearer team structure.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

The hire will lead the firm’s UK and Europe operations.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The financial services growth strategy could be “turbo-charged” by involving brokers, it said.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The investor has made four new investments post-H1.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

Munich Re is among the insurers with a stake in the German carrier.

-

-

The change forms part of a broader leadership reorganisation.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

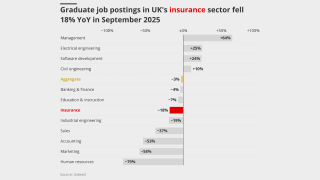

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Class actions and third-party litigation funding will drive up losses.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

White will join from Allianz trade, and Summers from Talbot.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

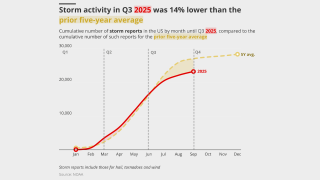

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.