Tysers

-

Several of Henrietta Butcher’s former Tysers colleagues have also moved to Lockton Re.

-

The broker has started hiring in London, taking Tysers D&O specialist Dan Lovett.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

The division reported revenue up 13.3% at A$465.9mn.

-

Neil Nimmo was CEO and chairman at Lockton International for more than 16 years.

-

The team is led by industry veteran John Lentaigne.

-

Plus, the latest people moves and all the top news of the week.

-

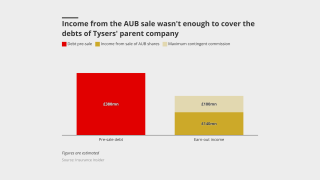

The IGH closure is bitter for employee investors left with nothing – but such investments are inherently risky.

-

After a two-year delay, more than 100 staff investors will be out of pocket.