-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

Transactions reveal the attractiveness of the "underwriting plus" business model.

-

Fleming Re bought the James River Re legacy book in 2024.

-

Plus, the latest people moves and all the top news of the week.

-

The country's competition commission said the takeover would result in less competition.

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

A look back at the year in (re)insurance, with the aid of some of our visual journalism.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

Canopius will continue to be one of several capacity providers to the MGA.

-

BNP Paribas will take a EUR1.11bn stake in Ageas.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

The transaction is expected to close early in the first quarter of 2026.

-

The company had argued the judge missed key info when dismissing the case.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The broker said the A$45-per-share price discussed valued the firm appropriately.

-

Better data validation and stronger claims controls are also key for MGAs.

-

Join senior market leaders for a forward-looking discussion on performance trends, pricing dynamics, M&A signals and risk appetite across both admitted and E&S segments.

-

The business was founded last year by former Beazley underwriter Richard Young.

-

In 2024, Aviva agreed to buy Direct Line for £3.7bn, which led its risk-adjusted capital score to fall.

-

The carrier is currently focused on ~$1bn bolt-on acquisitions.

-

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

MassMutual will retain an 82% stake in the $470bn asset manager.

-

Plus, the latest people moves and all the top news of the week.

-

What does it take to build a reinsurer that can manage volatility?

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

Plus, the latest people moves and all the top news of the week.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Munich Re is among the insurers with a stake in the German carrier.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Carriers are rethinking the traditional renewal-rights model.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The newly united company has set out ambitions to double in size by 2030.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

West Hill Capital is the main investor in the capital raise.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

The company will continue its capacity partnership with the MGA until 2030.

-

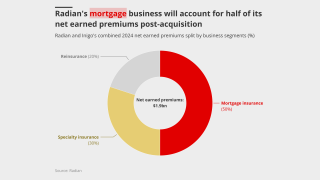

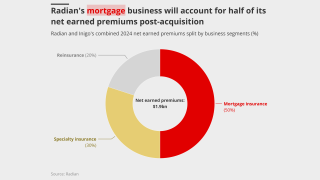

The deal will be watched closely by Radian’s handful of similar peers.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

Plus, the latest people moves and all the top news of the week.

-

Giles has spent more than five years at Themis Underwriting.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Lenders include Morgan Stanley, Permira and Bridgepoint.

-

An M&A senior analyst and M&A underwriter for emerging markets are also set to depart.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

The company, however, sets a high bar on making a move.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

It is understood that CyberCube has been considering a sale of the business.

-

The insurer has been under review with positive implications since March.

-

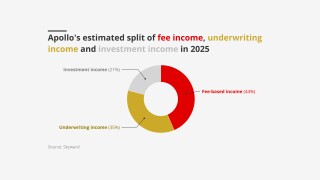

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

The deal ends Livingbridge’s two-year attempt to sell the UK broking/MGA platform.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Plus, the latest people moves and all the top news of the week.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.