-

China Taiping has been identified as the building owner’s insurer.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Willis reports that the mining market has softened at a ‘considerable rate’ this year.

-

The peril has been historically difficult to model compared to others.

-

After a challenging period, the industry is now earning above its cost of capital.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

The MGA began offering US commercial E&S property products in December.

-

Panellists said the industry must be deliberate in setting a strategy for the right outcomes.

-

The executive said the market will be revolutionised by digital technology.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

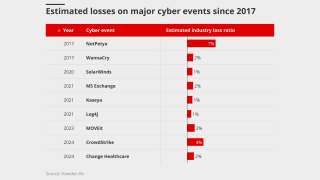

Cyber claims more than tripled year on year.

-

Graham Wynes has been at Lockton for more than 14 years.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The loss would be one of the largest ever for mining underwriters.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The June 2024 ransomware attack produced claims across many firms.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.