-

China Taiping has been identified as the building owner’s insurer.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Willis reports that the mining market has softened at a ‘considerable rate’ this year.

-

The peril has been historically difficult to model compared to others.

-

After a challenging period, the industry is now earning above its cost of capital.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

The MGA began offering US commercial E&S property products in December.

-

Panellists said the industry must be deliberate in setting a strategy for the right outcomes.

-

The executive said the market will be revolutionised by digital technology.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

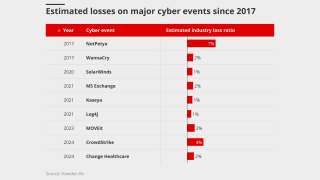

Cyber claims more than tripled year on year.

-

Graham Wynes has been at Lockton for more than 14 years.

-

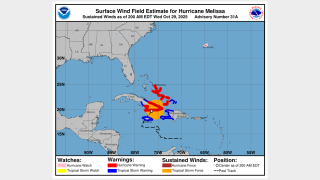

The (re)insurer has a higher-than-average Jamaican market share.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The loss would be one of the largest ever for mining underwriters.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The June 2024 ransomware attack produced claims across many firms.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

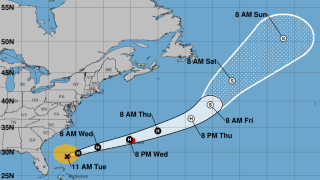

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The Boeing cargo aircraft was wet leased by Emirates.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Plus, the latest people moves and all the top news of the week.

-

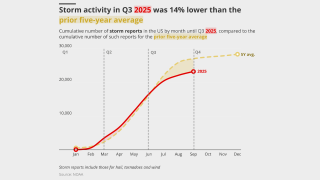

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Class actions and third-party litigation funding will drive up losses.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Moretti has relocated to California from London.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

Losses were primarily driven by personal property lines.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive said claims can be a differentiator in a softening market.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

Submission volume is up 10%-20%, according to sources.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The broker said 2026 will bring a “cautious but deliberate” aviation reinsurance environment.

-

She was most recently claims manager at QBE France.

-

The company was hit with a data breach on July 16.

-

Matthew Budd has over 30 years’ claims experience and previously worked for Talbot and XL.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

The estimate covers property and vehicle claims.

-

Steven Crabb will become deputy chairman on the insurance solutions division.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The syndicate now predicts a return on capacity for 2021 of between -5% and 5%.

-

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

Written premium increased by 31% to $2.41bn as top-line growth brought expense ratios down.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The figure updates an April estimate of EUR696mn.

-

Bridges joins from QBE, where he spent over 17 years.

-

Some 185 credit claims were reported in the market, totalling over $400mn.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

Plus, the latest people moves and all the top news of the week.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

Despite steep rate hikes, premium volume has held steady as players such as SpaceX self-insure.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Bridges had been at QBE for 17 years.

-

The claims specialist spent 30 years at Amlin before joining TFP.

-

Plus the latest people moves and all the top news of the week.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The claim hits the downstream market following a loss-hit start to the year.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The company said the reduction was due to years of steady improvements.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.