-

Price has become a key differentiator in marine and energy.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The highest portion of losses was experienced in Alberta.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

After a challenging period, the industry is now earning above its cost of capital.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

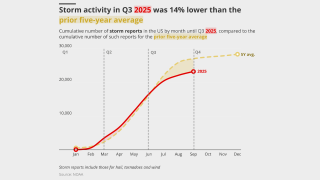

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Losses were primarily driven by personal property lines.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The estimate covers property and vehicle claims.

-

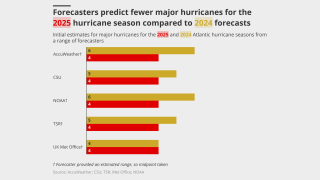

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

Written premium increased by 31% to $2.41bn as top-line growth brought expense ratios down.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Plus the latest people moves and all the top news of the week.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The company said the reduction was due to years of steady improvements.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

This year is predicted to be an above-average season, like 2024.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

Most of the losses are attributable to a supercell storm in Texas.

-

Almost 50,000 people have been forced to evacuate.

-

It previously predicted activity slightly below the 1995-2024 average.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The new CEO said recent purchases were designed to protect earnings volatility.

-

The carrier’s share price dropped 3.6% on its Q1 results.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

The firm now reports on insurance exposures to natural perils for 21 countries.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The worsening of extreme weather is becoming a global problem, presenting data challenges.

-

Storms in the UK and Ireland drove losses in the commercial segment.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The prediction comes after a highly active hurricane season in 2024.

-

The combined ratio improved by 1.9 points to 94.7%.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The carrier has received 12,300 claims as of 28 March.

-

Analysts see Conduit’s extra reinsurance buying as a positive development.

-

The event has caused widespread damage in Bangkok, Thailand.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Cat losses from Helene, Milton and the Oklahoma tornadoes will fall within expectations.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

The syndicate expects to book a combined loss of £39mn from hurricanes Helene and Milton.

-

Plus, the latest people moves and all the top news of the week.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The syndicate achieved a profit despite a “relatively heavy” catastrophe year.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Some of the Big Four are slowing growth as the market softens.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier was seeking to expand its 1 March-renewing programme.

-

Reinsurers’ hopes that LA wildfires will slow 1.4 softening are in question.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Both carriers have extensive reinsurance coverage.

-

Aviation reserve strengthening added 10.1 points to the combined ratio.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

While market underwriting profit slipped 10%, the underlying combined ratio was under 80%.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

Almost 300,000 people have been left without power from the storm.

-

This loss number covers the property line of business.

-

CEO Alex Maloney said the LA fires might prompt some carriers to go more “risk-off”.

-

The London D&F market will shoulder most of the losses.

-

The reinsurer pegged the market loss at $40bn.

-

North America is likely to be the most financially impacted by the scenario, Lloyd’s said.

-

Ascot Underwriting CEO Ian Thompson, who took the helm last summer, discussed emerging headwinds.

-

The programme structure was expanded, but it is unclear what percentage was placed.

-

Plus, the latest people moves and all the top news of the week.

-

The company also announced a EUR2bn share buyback.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

CEO Andreas Berger addressed Swiss Re’s primary aviation exit.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The carrier expects the market loss to land at $35bn-$40bn.

-

The carrier pegged its claims expenditure for the LA wildfires at EUR1.2bn.

-

The reserve includes hull, liabilities and legal expenses.

-

Cedants could choose to retain more as cross-share sell-offs boost their capital.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Plus, the latest people moves and all the top news of the week.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The carrier pegged its California wildfire losses at $200mn pre-tax.

-

In tandem, it pegged its net cat loss estimate from California wildfires at $160mn-$190mn.

-

The carrier said 72% of those losses occurred in personal property.

-

The chairman said the recent events were akin to Andrew, Katrina and the WTC.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

A higher loss quantum will put a greater burden on retro programmes.

-

The carrier expects to book $100mn-$140mn from the California wildfires.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The crash is the latest of several losses for aviation insurers in recent months.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

More than 33,000 claims had been filed as of 5 February.

-

The estimate covers property and vehicle claims.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The carrier enters H2 with a clean reinsurance programme.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

The company did not take questions on its recently announced business review.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier is likely to exceed its Q1 large-loss budget due to the California wildfires.

-

The specialty insurer reported favorable developments in both its insurance and reinsurance segments.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The company’s reinsurance business also has some exposure, the executive said.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

The figure does not include specie or auto losses.

-

The nationwide carrier ranked sixth for multi-peril California homeowners' insurance in 2023.

-

Munich Re and Berkshire Hathaway are among the major providers to large California cedants.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

The California fires will test post-2018 treaty revisions – and reinsurers’ nerves.

-

Guy Carpenter said personal-lines exposure would account for 85% of the aggregate loss.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

Disclosures show the insurer has roughly 4,300 homeowners’ policies in effect in fire-impacted zip codes.

-

The broker said disaster data can attract more risk capital.

-

The pool services a number of public authorities in California.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

The members’ agent said 2024 will still be a profitable year for Lloyd’s.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

Losses are likely to fall within syndicates’ loss budgets, it said.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Investigators are homing in on the likely causes of the incidents.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The fast-moving blazes have prompted evacuations across the city.

-

More than 4,000 acres are burning as thousands evacuate.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

High deductibles, tighter underwriting and lack of flood cover meant lower claims figures.

-

The storms struck Victoria, New South Wales and Queensland.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

A look back at the year in (re)insurance, with the aid of some of our visual journalism.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

Swiss Re reported some $743mn in catastrophe losses for Q3 alone.

-

The company said it is still on target to achieve $3bn net income for the full year.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

The carrier’s retail division saw the largest growth at 4.7%.

-

The carrier has pegged preliminary pre-tax Milton losses at less than $200mn.

-

Most of the losses derive from France.