-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The broker said the A$45-per-share price discussed valued the firm appropriately.

-

The business was founded last year by former Beazley underwriter Richard Young.

-

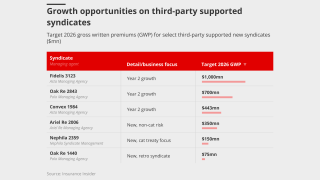

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

The hedge fund had significant investment aims for the London market.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The federation, FASE, aims to connect all participants to provide a voice for European MGAs.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

West Hill Capital is the main investor in the capital raise.

-

The business has been ~70% owned by White Mountains since January 2024.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.