-

Plus, the latest people moves and all the top news of the week.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

The syndicate will be managed by Polo Managing Agency.

-

Oaktree will fund the syndicate and act as investment manager for its assets.

-

The review found an unrelated breach over the CEO failing to log a journey on a private jet.

-

Plus, the latest people moves and all the top news of the week.

-

One critical sticking point for Lloyd’s is the true alignment of interest with the market.

-

The underwriter has spent 30 years in fine art insurance.

-

The Lloyd’s Market Association (LMA), setting out its “core asks” for 2026, has said it is expecting the market to achieve multiple peer-to-peer technology adoptions next year.

-

The transaction is expected to close early in the first quarter of 2026.

-

Smaller syndicates are lifting their share of the market, as the top quartile also returned to growth.

-

The chief of market performance urged underwriters not to follow the herd.

-

Six of the 10 largest syndicates remained flat or reported de-emptions.

-

Lower rates and currency shifts have pushed syndicates to cut stamp.

-

Nobody likes flying in turbulence, and in recent years aviation insurers have faced their fair share of upheaval.

-

The chief of market performance urged syndicates not to “pull forwards” tougher conditions by chasing topline.

-

The syndicate was launched at Lloyd’s last year.

-

Simon Mason will continue to support the business through the upcoming reinsurance renewals.

-

The system is designed to pay claims faster as well as improving capital efficiency.

-

The association has teamed up with Lloyd’s on a women’s underwriting summit.

-

Plus, the latest people moves and all the top news of the week.

-

The developments this week thrust culture issues up the agenda for new leadership.

-

Sheila Cameron called on Lloyd’s to “accelerate” its commitment to behavioural change.

-

Aegis, Beazley and others are among those cutting stamps.

-

Whether Rebekah Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The Australian insurer is a major cat cedant and had hoped to set up a reinsurance syndicate.

-

At our London conference, executives saw various routes to growth, even as headwinds grow.

-

Sharp will remain for the 2026 renewal process, before pursuing a new opportunity in the market.

-

The syndicate aims to write £80mn of programme business in 2026.

-

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

Apollo CEO David Ibeson was also in the running for a seat on Council.

-

Plus, the latest people moves and all the top news of the week.

-

Innovation emerged as the critical target for attracting new business to London.

-

What does it take to build a reinsurer that can manage volatility?

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

This publication revealed Volante was in talks with legacy players last month.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

The move to launch a second syndicate was reported by Insurance Insider in June.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

The hedge fund had significant investment aims for the London market.

-

Plus, the latest people moves and all the top news of the week.

-

The consortium will target excess layers, providing $250mn of capacity.

-

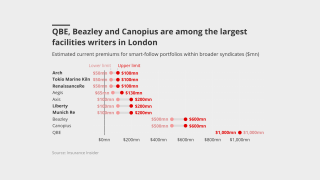

The CEO said smart-follow is a structural evolution of the specialty market.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

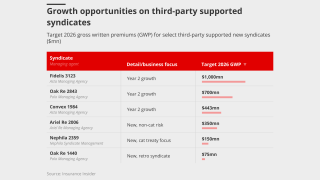

The syndicate is expected to write ~$300mn of business in 2026.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The number of syndicates traded at auction was the highest for a decade.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The company noted tougher market conditions and higher large losses during the year.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The two lines will add £11mn in planned premium.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

Plus, the latest people moves and all the top news of the week.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.