RenaissanceRe

-

Improved performance and growing investment returns played a role in the upgrade.

-

Cat portfolios generally grew, but casualty approaches varied.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

The firm said supply and demand was becoming more in balance than at 1 January renewals.

-

The property segment experienced a 113.5-point impact from the California wildfires.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Deteriorating CoRs, GWP growth and fears over wildfire impacts were common themes.

-

The reinsurer is ready to deploy additional capacity following the event, but only if prices are commensurate with risk.

-

Hurricane Milton brought the firm net losses of $270mn in Q4, while it forecast up to a $750mn wildfire hit for Q1.

-

The reinsurer tends to support a number of syndicates where it has a potential relationship.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

Hurricane Milton is estimated to have a net negative impact of $275mn on Q4 results.

-

Everest Re bucked a more general trend to keep cat exposure stable.

-

The property market remains “one of the most favourable... I've seen in my career", he said.

-

The property CoR improved by 9.1 points, while casualty and specialty’s fell 5 points.

-

The specialty treaty market is preparing to deal with the fallout from the Baltimore bridge disaster.

-

The Bermudian has been reducing exposure in Florida for almost a decade.

-

The property CoR improved by 13.7 points, while casualty and specialty’s deteriorated by 6.7 points.

-

The 100% equity award will vest in full after five years.

-

Sven Wehmeyer, Jodie Arkell, Hugh Brennan and Ed Cruttenden have new roles.

-

Strong reinsurance results have absorbed long-tail reserve charges.

-

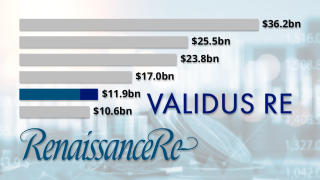

The initial plan was to renew $2.7bn of the acquired book.

-

This was RenRe’s first set of quarterly results after its takeover of Validus.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Other senior executives, including CFO Robert Qutub and general counsel Shannon Bender, received stock awards of $750,000 for their involvement in the Validus Re acquisition.

-

The number of staff retained contrasted with more dramatic cuts made after the acquisition of Tokio Millennium and Platinum.

-

After moving into the rank of fifth-largest reinsurer, following its acquisition of Validus, RenRe said it would continue to take a leading role in the regional cat space and expected to be more able to trade through market cycles.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The Bermudian also disclosed that it raised $16.3mn of third-party capital in Medici during the quarter.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The Bermudian’s global property CUO and European chief says it is ready to expand if conditions remain favourable.

-

The reinsurer said it was monitoring conditions in the property E&S markets, where it has been reducing capacity to grow in property treaty, as rate gains could provide fertile ground for future growth.

-

Large loss events resulted in a net negative impact of $68.5mn on the property segment’s Q2 underwriting results.

-

The reaction to capital raising this year signals that investor belief in risk-takers is reinvigorated.

-

RenaissanceRe has said it hopes to retain as much as 90% of the Validus Re portfolio, but where are the highest areas of overlap by cedant?

-

Morgan Stanley and Golman Sachs exercised in full their right to buy 945,000 shares in the company.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

The deal is the third scale-up buyout for the firm, highlighting the ongoing value of scale in the reinsurance segment.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal represents RenRe’s third Bermuda consolidation deal following Platinum and TMR.