-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

Plus, the latest people moves and all the top news of the week.

-

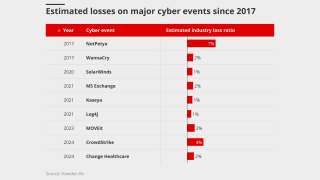

A canvassing of the cyber market suggests the impact will be negligible.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

The change forms part of a broader leadership reorganisation.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

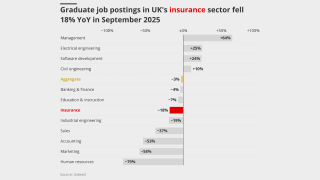

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Class actions and third-party litigation funding will drive up losses.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

In July, he took the role on interim basis from Laure Forgeron.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Plus, the latest people moves and all the top news of the week.

-

The facility will initially focus on US, Bermudian and European business.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Tim Barber joins from QBE Re, where he was head of North America.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

James River said the court was right to dismiss the fraud case.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.