North America

-

Tokio Marine HCC, Chubb, IQUW and BluNiche are also on the tower.

-

Nick Durant helped launched Lockton Re North America in 2019.

-

The unit will be led by Ed Hochberg, global risk solutions leader at Guy Carpenter.

-

Syndicate 3705 adds to the MGA’s roster of capacity providers.

-

Weather events and potential increases in US casualty reserves remain sources of volatility.

-

Zaffino will become executive chair of AIG and retire as CEO by mid-year.

-

Gallagher’s $13.45bn deal for AssuredPartners was completed in August.

-

The move comes after a 200+ person mass team lift from Brown & Brown’s retail business in the US.

-

Ashleigh Edwards will report to group CUO Mark Pepper.

-

This publication exclusively revealed the $1bn deal last November.

-

Reinsurers’ average RoE was 16% as of September 2025.

-

The US CEO said the acquisition will be “truly transformative” for its TL clients.

-

Atlantic’s founders are to become Howden shareholders.

-

The underwriting unit has also rebranded D&O specialist Leopanthera.

-

The president and CEO will also be eligible for up to $50mn in shares.

-

Tom Wakefield says there is scope for opportunistic reinsurance purchases in 2026.

-

The renewal was characterised by abundant capacity and strong competition.

-

The market was unphased by January’s record wildfire loss in Los Angeles.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

The pricing battle has been played out but the extent of new demand will only show up in 2026.

-

Jim Hays outlined $90mn in stock losses as Howden called Brown & Brown’s narrative “false and inflammatory”.

-

Verisk entered the agreement to purchase the SaaS platform in July this year.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Price has become a key differentiator in marine and energy.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

Insurance Insider reflects on major loss events of 2025 for the London market.

-

Cedants are opting to bank double-digit savings as reinsurers fight for market share.

-

Sources said hundreds of Brown & Brown staff across various offices have left to join Howden US.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

Justin Camara was EVP and portfolio director for financial and professional liability.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Solutions are being used to fill the gap left by traditional agg markets.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The highest portion of losses was experienced in Alberta.

-

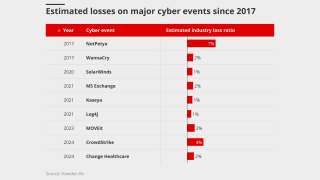

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

According to the Civil Unrest Index, protest activity has soared over the past two years.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The transaction is expected to close early in the first quarter of 2026.

-

The company had argued the judge missed key info when dismissing the case.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

Next year will mark five consecutive years of insolvency increases.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The peril has been historically difficult to model compared to others.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Habayeb will start next May following Kociancic's retirement.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Stephenson will start his new role in early 2026.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

Existing facilities and carrier partners will be transferring from K2.

-

Panellists said the sector must communicate its value in language tailored to each client.

-

MassMutual will retain an 82% stake in the $470bn asset manager.

-

A motion by defendants to dismiss the case was also denied.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

The June 2024 ransomware attack produced claims across many firms.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Lack of major cat events could add further pressure on 1 January pricing.

-

Marsh is also suing a second tier of former Florida leaders.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The broker will report to Howden US CEO Mike Parrish.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Brian Church has spent 20 years at Chubb.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers are rethinking the traditional renewal-rights model.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.