-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

The CEO said smart-follow is a structural evolution of the specialty market.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

A roundup of all the news you need, including fatal UPS cargo crash.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

Marsh is also suing a second tier of former Florida leaders.

-

The broker’s hiring to date has focused on the specialty segment.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

A roundup of all the news you need, including Conduit Re's CUO appointment.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

The federation, FASE, aims to connect all participants to provide a voice for European MGAs.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

Widespread underinsurance and low exposures will limit losses.

-

A roundup of all the news you need, including analyst reactions to Scor’s Q3 results.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The energy broker’s career also includes a stint at Price Forbes.

-

Regulators do too little to distinguish between generalists and specialists, he said.

-

A roundup of all the news you need, including our Carbon scoop.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

The broker grew earnings per share by 12.1% during the quarter.

-

Plus, the latest people moves and all the top news of the week.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

The broker will join Ron Borys’ financial lines team.

-

-

The broker has more than 20 years’ experience in the energy market.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

A roundup of all the news you need, including the Convex-Onex deal.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

In insurance, premium growth came from all lines of business except cyber.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

A roundup of all the news you need, including the purchase price for the AIG-Everest deal.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

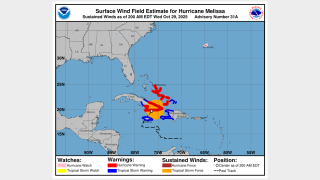

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

A roundup of all the news you need, including Jason Keen's promotion at Everest.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

Jason Keen joined Everest in 2022 as head of international.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

A roundup of all the news you need, including the latest on Hurricane Melissa.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

The London MGA is considering various options, including a minority investor.

-

The carrier recently expanded its reinsurance product suite in Bermuda.

-

A roundup of all the news you need, including our analysis of the recent AWS outage.

-

The number of syndicates traded at auction was the highest for a decade.

-

Plus, the latest people moves and all the top news of the week.

-

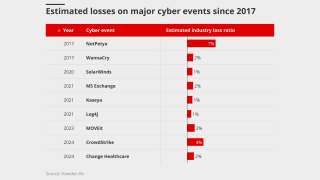

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.