Munich Re

-

The group aims for earnings per share growth of more than 8%.

-

The carrier said it will leverage its strong position in the ongoing favourable environment.

-

Colette Buckley joins Steven Ridgers, who became Axis head of erection all risks in October.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Insurers must avoid being a “blocker” in development and financing decisions.

-

Plus, the latest people moves and all the top news of the week.

-

Property growth plans are cooling, but favourable loss trends will increase surplus capacity.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Munich Re is among the insurers with a stake in the German carrier.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The insurer has been under review with positive implications since March.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Plus, the latest people moves and all the top news of the week.

-

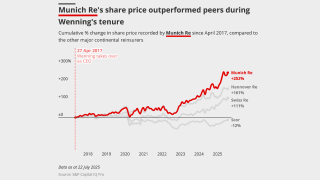

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

New entrants to the line of business have heightened competition for talent.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Plus the latest people moves and all the top news of the week.

-

The carrier’s share price dropped 3.6% on its Q1 results.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

Simon Horton spent 10 years at Marsh before joining AIG last year.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Several insurers and MGAs have launched into the class of business over the past year.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Plus, the latest people moves and all the top news of the week.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

Some of the Big Four are slowing growth as the market softens.

-

Navigating its path to global specialty growth will require operational dexterity.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier will look to grow business outside North America.

-

The carrier expects the market loss to land at $35bn-$40bn.

-

The carrier pegged its claims expenditure for the LA wildfires at EUR1.2bn.

-

The portfolio tracker facility is led by Canopius.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Christa Schwimmer has joined the leadership team alongside Stefan Golling.

-

The P&C re unit will aim for a 79% combined ratio next year.

-

The carrier attributed the intensification of storms this season to climate change.

-

The underwriter has spent his career so far with Talbot.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Major-loss expenditure doubled to EUR1.6bn for the quarter

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

The reinsurer said three Canadian loss events in the quarter will lead to similar claim expenditure as Hurricane Helene.

-

The new product adds to its existing portfolio of upstream energy and marine and energy liability business.

-

The carrier is looking to grow its specialty offering across Europe and APAC.

-

How is the market positioned to withstand Hurricane Milton?

-

The Madrid branch will look to begin underwriting primary specialty insurance in 2025.

-

The executive joins Munich Re from Amwins Global Risks.

-

Patrice Michellon, who has spent more than eight years with the reinsurer, will report to Clarisse Kopff.

-

Munich Re's core message this year is that its risk appetite is “quite stable”.

-

Plus the latest people moves and all the top news of the week.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Plus the latest people moves and all the top news of the week.

-

The reinsurer also said it expected no significant impact from the CrowdStrike losses.

-

Its combined ratio stayed under 80%, which may give it room to outperform on annual targets.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

The ratings agency said Munich Re demonstrated its ability to optimise its market-leading position.