-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The energy broker’s career also includes a stint at Price Forbes.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

In insurance, premium growth came from all lines of business except cyber.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

Plus, the latest people moves and all the top news of the week.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

Beazley is one of the key leaders in the London marine marketplace.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

The Boeing cargo aircraft was wet leased by Emirates.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The two lines will add £11mn in planned premium.

-

Plus, the latest people moves and all the top news of the week.

-

David Bell has held aviation roles at Marsh, AIG, Gallagher Re and Aon.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

The executive has run the MGA platform since its 2017 inception.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Brian Church has spent 20 years at Chubb.

-

The group will join forces with SRG subsidiary Miles Smith.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

White will join from Allianz trade, and Summers from Talbot.

-

Plus, the latest people moves and all the top news of the week.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Incumbent Jane Warren will retire at the end of the year.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

The underwriter has worked for Markel in Singapore since 2020.

-

Samir Hemsi was CUO at Westfield Syndicate and sat on the firm’s board of directors.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

West Hill Capital is the main investor in the capital raise.

-

The aviation market has experienced a run of large losses this year.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

High capacity is adding to competition in the upstream energy space.

-

The firm offered W&I cover with capacity of up to £16mn per transaction.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

The pair have expanded remits overseeing property and specialty.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Cyberattack/data breach remains in the top slot.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

The company will continue its capacity partnership with the MGA until 2030.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Howden’s portion of the US retailer’s premium is in particular focus.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

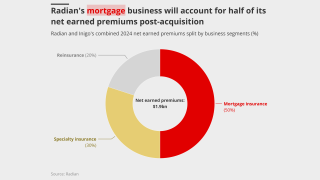

The deal will be watched closely by Radian’s handful of similar peers.

-

Sean McGovern will step down from the role in December.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

The veteran underwriter said market conditions are still ‘robust’.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Global pricing is now 22% below the mid-2022 peak.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

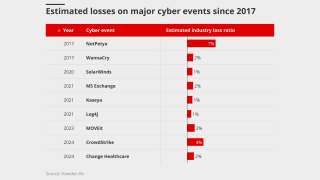

The report highlighted the gap between insured and uninsured attacks is widening.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

Plus, the latest people moves and all the top news of the week.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

It said the loss did not reflect the underlying economic performance of the business.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

A decision in relation to who bears which legal costs will be reached at a later date.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

The executive joins from MSIG USA.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The carrier started writing construction in Lloyd’s following the acquisition of Probitas.

-

Giles has spent more than five years at Themis Underwriting.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

The tech firm is building a joint stock company with insurers and investors.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Mark Connellan is the latest addition to Bassel Matta’s team.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

New capacity continues to flow into the hull market, despite rating pressure.

-

An M&A senior analyst and M&A underwriter for emerging markets are also set to depart.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

The vehicle will provide a streamlined route for capital to its client MGAs.

-

The pair were offered contracts by Willis Re in July.

-

Pine Walk has grown substantially and is on course to write $1.2bn of premium this year.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The Argenta-backed MGA is already active in the cargo and property classes of business.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Swiss carrier appointed a new global energy head earlier this week.

-

Heyburn joins from Brit, where he was A&H class underwriter.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Growth in the SME sector could help stabilize the market, however.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The executive said claims can be a differentiator in a softening market.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

Sébastien Bardy joins from Allianz to lead the firm’s financial scale-up.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The carrier is looking to take a lead position in energy-transition risks.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

Plus, the latest people moves and all the top news of the week.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

Submission volume is up 10%-20%, according to sources.

-

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The division reported revenue up 13.3% at A$465.9mn.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

What happens when a global broker network decides to fill a gap in the London market itself?

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

The broker said 2026 will bring a “cautious but deliberate” aviation reinsurance environment.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

The news comes after the announcement of CEO Graham Evans’ departure.

-

A key hearing in the poaching case is set for 4 September in New York.

-

-

She was most recently claims manager at QBE France.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

There has already been an influx of new capacity from MGAs into the power market.

-

The carbon-credit insurer has appointed James Morrell head of credit underwriting.

-

The company was hit with a data breach on July 16.

-

Plus, the latest people moves and all the top news of the week.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Matthew Budd has over 30 years’ claims experience and previously worked for Talbot and XL.

-

The overseas division booked a combined ratio of 94% for the quarter.

-

Beth MacGregor and Adam Vulliamy are also set to join from Axis Capital.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The insurer has substantially expanded its marine team in recent years.

-

The London carrier missed consensus on gross and net premiums for H1.

-

Brokers turn to harder classes, innovation, commissions and tech to soften the blow.

-

The announcement comes a week after the institutional investor said it would accelerate its pivot to an insurance-led strategy.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

Part of the syndicate’s premium for clinical-trial-funding cover will move to Syndicate 1902.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

The repricing on the broker’s $3.1bn term loan will save an estimated $8mn per year.

-

The syndicate now predicts a return on capacity for 2021 of between -5% and 5%.

-

Robert James is set to join the Bassel Matta-led team.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The Lloyd’s carrier is expected to try to claim multiple times under the policy.

-

Philip Dalton succeeds partner Colin Hasler, who has retired after a 42-year career.

-

Plus, the latest people moves and all the top news of the week.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The carrier reported an increase of 82% in pre-tax income.

-

The underwriter left Navium Marine last year and before that worked at Atrium.

-

The move will impact around $50mn of gross written premiums in total.

-

Cat losses of $1.5mn, net of reinsurance, were primarily due to severe convective storms.

-

Duc Tu and Lucy Howard have resigned from Atrium.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

Arch will continue to provide long-term capacity for the MGA.

-

The company has also expanded its relationships with US and UK MGAs.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The Canadian insurer saw property rates dip across its global divisions.

-

Alistair Lester joins from Aon, where he has worked for the past eight years.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

Stacey Hinton and Max Elliot are set to join Ark from Markel International.

-

In May, we revealed that Lockton's James Campbell is leaving for a role in HWF’s real estate team.

-

Nicolau Daudt will become global specialty CEO, as previously announced.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The carrier had $20mn in reserve releases in the quarter, compared to nil in Q2 2024.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Matthew Flynn joins from RenaissanceRe.

-

The firm has quadrupled its Ebitda since 2022.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The search for a successor to lead Syndicate 1200 is underway.

-

Demian Smith joins from Guy Carpenter.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

PE owner Livingbridge brought the broker to market two years ago.

-

The former Everest executive has more than 30 years of A&H experience.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Property rates declined by 7% globally in the second quarter.

-

Jim Franson joins from Validus Re, where he was US president.

-

Lucy Fraser has held roles at the ABI, and the City of London Corporation.

-

Dart succeeds Andrew Carrier, who will retire at the end of the year.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

Some 185 credit claims were reported in the market, totalling over $400mn.

-

Frank Masteling will lead the new business as head of trade credit.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

The carrier’s top line grew to $890m in the first half of 2025.

-

Sources said MarshBerry is advising the underwriter.

-

The MGA no longer has an FCA licence and was wound up in May.

-

Underscoring a more competitive market, the structure includes an escalating premium.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

The carrier has also hired Imogen Wright as underwriter marine and energy treaty.

-

Tokio Marine GX was launched in May to offer coverage for companies looking to decarbonise.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Fidelis, Liberty and Hive are among the insurers with the greatest exposure.

-

Despite steep rate hikes, premium volume has held steady as players such as SpaceX self-insure.

-

The carrier has appointed Roberts Proskovics as renewable energy risk management head.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

The MGA has recently added casualty and specialty reinsurance divisions.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

The company launched into the contingency market in the wake of the Covid-19 pandemic.

-

The executive has spent 13 years in the broker’s marine division.

-

Plus, the latest people moves and all the top news of the week.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Claire Janaway is leaving the carrier after 19 years.

-

The start-up aims to bind its first risk in Q4 2025.

-

The insurer has hired Coface’s Hélène Martin to support its expansion.