-

Plus, the latest people moves and all the top news of the week.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

The London carrier has explored how businesses are navigating an era of accelerating risk.

-

New Nuclear is currently raising capacity, with an eye to launch in 2026.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Simon Mason will continue to support the business through the upcoming reinsurance renewals.

-

The MGA has expanded its suite of products since launching last year.

-

Loss activity in the upstream market remains benign, adding to softening.

-

Insurers must avoid being a “blocker” in development and financing decisions.

-

Volt was launched in October 2024 to support clients through the energy transition.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

The power market is experiencing double-digit rate reductions.

-

Longbrook Insurance will write multiple lines of business.

-

The energy broker’s career also includes a stint at Price Forbes.

-

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

The underwriter has worked for Markel in Singapore since 2020.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

High capacity is adding to competition in the upstream energy space.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

Plus, the latest people moves and all the top news of the week.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The carrier is looking to take a lead position in energy-transition risks.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

There has already been an influx of new capacity from MGAs into the power market.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Sources said MarshBerry is advising the underwriter.

-

Tokio Marine GX was launched in May to offer coverage for companies looking to decarbonise.

-

The carrier has appointed Roberts Proskovics as renewable energy risk management head.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

The executive has spent 13 years in the broker’s marine division.

-

Plus, the latest people moves and all the top news of the week.

-

The MGA will write natural resources professional liability business.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

Plus the latest people moves and all the top news of the week.

-

Clients are increasingly using captives because of uncertainty around long-term capacity commitments.

-

The carrier has entered several new classes recently, including specie and reinsurance.

-

The claim hits the downstream market following a loss-hit start to the year.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

Although US pricing is improving there is pressure in other geographies.

-

The underwriter joined MS Amlin in 2020 after more than 24 years with Markel.

-

-

There has been significant talent displacement in the specialty reinsurance market.

-

TMGX is designed to help insure the green transition.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The worsening of extreme weather is becoming a global problem, presenting data challenges.

-

Softening in the upstream market has also accelerated beyond expectations.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

Argenta will also manage the run-off and renewal of the previous White Bear binder.

-

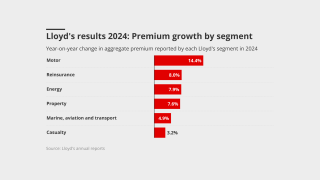

Reinsurance and property remained the primary drivers of premium growth.

-

The product supports investors of early-stage carbon removal projects.

-

The broker has also named Andrew Herring chair of the division from next year.

-

The binder will provide capacity for international fac property, power and onshore energy.

-

The Corporation said pricing within aviation was “almost certainly inadequate”.

-

The broker said the list of perceived obstacles was “fairly damning” for insurers.

-

Earlier this week, we revealed that Louise Nevill was joining Axa XL as specialty CUO.

-

Competition for specialty reinsurance talent remains high.

-

Camilla Gower joined TMHCCI in 2020 from StarStone.

-

Two major claims have prompted underwriters to question the sustainability of double-digit rate decreases.

-

The broker joined the Ardonagh Group from Gallagher’s Alesco in 2017.

-

The MGA launched last October with a B.P. Marsh investment.

-

Good ESG practices are part of good risk management, the company said.

-

Seven team members are set to exit, including team lead Cooke.

-

Plus, the latest people moves and all the top news of the week.

-

Sources said the claim is likely to be a multi-hundred-million-dollar event.

-

The upstream market has undergone a period of high personnel movement.