-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The data available can “help to inform” a carrier’s strategy in the open market.

-

Plus, the latest people moves and all the top news of the week.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The London carrier has explored how businesses are navigating an era of accelerating risk.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

In mid-morning training, the share price had fallen by 12%.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The carrier plans to invest $500mn in capital to establish a presence in Bermuda.

-

Call for public and private partnership in cyber are not new, but sentiment remains divided.

-

This publication reported in October that Debbie Hobbs was to exit Miller after four years.

-

Cyber claims more than tripled year on year.

-

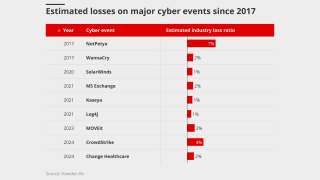

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The June 2024 ransomware attack produced claims across many firms.

-

Cyber, mortgage and crop were identified as attractive growth areas.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Plus, the latest people moves and all the top news of the week.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Global pricing is now 22% below the mid-2022 peak.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

It is understood that CyberCube has been considering a sale of the business.

-

Growth in the SME sector could help stabilize the market, however.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

-

The company was hit with a data breach on July 16.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Property rates declined by 7% globally in the second quarter.

-

Lucy Fraser has held roles at the ABI, and the City of London Corporation.

-

The MGA no longer has an FCA licence and was wound up in May.

-

Underscoring a more competitive market, the structure includes an escalating premium.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The cyber business will continue to operate as a standalone entity.

-

Carriers expect a rise in the severity and frequency of claims over the next two years.

-

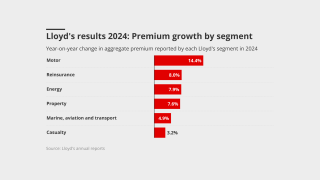

Premium rose across the top 15 P&C risks in 2024.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

Is the ransomware threat really getting worse – or just more visible?

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The facility, backed by six global cyber insurers, offers limits of as much as EUR5mn.

-

The firm believes UK support for policyholders is under-served compared with the US.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

Coverage has broadened while limits have increased, the broker said.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The executive was formerly the head of cyber solutions, North America.

-

The carrier has scaled up its international insurance offering in recent years.

-

The protection gap is calling into question the relevance of the insurance industry.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

Plus, the latest people moves and all the top news of the week.

-

What’s next for Conduit Re’s strategy following a leadership shake-up?

-

Plus, the latest people moves and all the top news of the week.

-

While M&S had a cyber policy in place, Co-op and Harrods did not, Insurance Insider revealed.

-

M&S, which still faces disruption from the attacks, had coverage lead by Allianz.

-

The hire is the latest in the newly formed carrier’s buildout.

-

Plus the latest people moves and all the top news of the week.

-

-

Soft conditions have led to “less acute" underwriting discipline, sources said.

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

Ransomware threat actors are continuing to attempt ‘smash and grab’ attacks.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

Joanne Barry will be joining the team at Zurich.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The underwriter is taking on a role with Cipriani and Werner.

-

The only major product line to see rate increases was casualty.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

The facility now includes CyXS Plus and CyXS Company.

-

James Barrett has been interim head of cyber since October 2024.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

Ethan Godlieb will be leading cyber, tech and fintech for the broker.

-

Reinsurance and property remained the primary drivers of premium growth.

-

Cyber, marine and aviation are recent areas of focus.

-

The broker has launched a company market section of the facility called Encore.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The product provides primary and excess coverage limits up to £5mn.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

The MGA’s US clients will now have access to London market capacity.

-

This year's modelled outputs have increased across all return periods.

-

The CMC will categorise cyber events that have a potential financial impact of £100mn+.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

Jason Hart, head of proactive cyber, was also promoted to managing director.

-

-

Panellists discussed the softening market, and what would flip the switch on rates.