-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

The broker’s hiring to date has focused on the specialty segment.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

This publication revealed the move earlier this year.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

The two lines will add £11mn in planned premium.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Rachel Webber was most recently head of non-marine at TransRe.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Class actions and third-party litigation funding will drive up losses.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Plus, the latest people moves and all the top news of the week.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

Carriers are rethinking the traditional renewal-rights model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

In July, he took the role on interim basis from Laure Forgeron.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Joel Hodges will run the international business as managing director.

-

Volante launched Syndicate 1699 in 2021.

-

Improved performance and growing investment returns played a role in the upgrade.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

Several airlines are understood to have come to market early.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

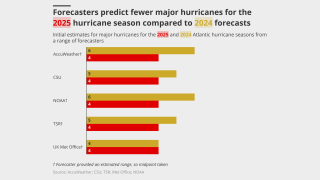

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The economic loss from the event was around EUR7.6bn.

-

The move comes as the broker rebuilds its Bermuda team.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Plus, the latest people moves and all the top news of the week.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

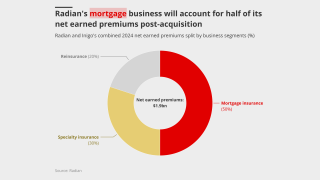

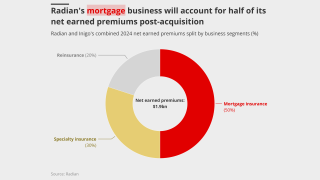

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The combined casualty treaty team has also made a number of hires.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The business said it was experiencing strong momentum on the Island.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Losses were primarily driven by personal property lines.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

The new recruit will report to group CUO Ian Houston.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Climate risk challenges conventional underwriting wisdom but also brings new opportunities.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The company, however, sets a high bar on making a move.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The pair were offered contracts by Willis Re in July.

-

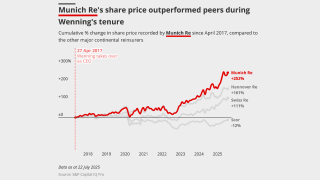

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

Maintaining underwriting discipline was central to the Corporation's messaging.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

The treaty underwriter is set to run an MGA within the group.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The executive most recently served as head of North American treaty reinsurance.

-

The executive has worked at RFIB, Benfield and Guy Carpenter during his 30-year career.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

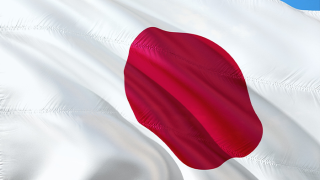

The Japanese carrier faces integration challenges to make a success of the deal.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

The executive will buy reinsurance for HDI and Talanx’s corporate unit.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The group claims the White House is undermining disaster preparedness.

-

The Bermudian reiterated its pledge to improve performance.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

The deal was announced last month.

-

Candy Wong spent 30 years at Aon Re China before a stint at Guy Carpenter.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Covea had requested a stay in the proceedings.

-

The overseas division booked a combined ratio of 94% for the quarter.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

The Lloyd’s carrier is expected to try to claim multiple times under the policy.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier reported an increase of 82% in pre-tax income.

-

The forecast has increased since the early July update due to several additional factors.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The carrier said most lines remained well priced despite increased competition.

-

Prior-year reserve development moved to a $6.3mn charge in Q2 from a $19.3mn release a year ago.

-

The executive has spent more than three decades in insurance.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

Plus, the latest people moves and all the top news of the week.

-

The transaction is expected to have a price-to-earnings multiple of 11x.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

The French carrier’s first-half revenues were driven by 6% growth in P&C.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Everest booked $98mn of aviation losses related to the war, which contributed 2.5 points to the consolidated CoR.

-

The CEO said business remains adequately priced in most classes.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The carrier said market dynamics were shifting due to increased capacity.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The facility was previously for commercial risk clients.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Jill Beggs was most recently COO for reinsurance.

-

The reinsurance unit’s combined ratio for the quarter was 94.2%.

-

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The agreement is the second service contract the group has taken on.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

The medical professional liability firm is targeting further healthcare opportunities.

-

The broker said the appointments are designed to drive growth.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The US accounted for 92% of all global insured losses for the period.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

US events accounted for more than 90% of global insured losses.

-

The company launched into the contingency market in the wake of the Covid-19 pandemic.

-

Plus, the latest people moves and all the top news of the week.

-

Andrew Creed has been promoted to group president in addition to his role as group CFO.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

The new roles will oversee property, specialty and credit.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

Parent Aventum said co-CEO Paul Richards remains with the business.

-

The weather-modelling agency is predicting a below-normal season.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Bridges had been at QBE for 17 years.

-

The claims specialist spent 30 years at Amlin before joining TFP.

-

The former Hiscox Re & ILS specialty underwriter starts on 7 July.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

The take-private deal was announced in July 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The new chair said the market must adapt for 2030 and beyond.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

Separately, Caribbean market head Janine Seifert is leaving the reinsurer for BMS Re.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

The company said the reduction was due to years of steady improvements.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The broker noted a “significant variation” in renewal outcomes.

-

The measure could have landed insurers with extra tax on US business.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The new unit – Ceded Re – will operate under the leadership of Guy Van Hecke.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

R&Q Gamma’s outstanding liabilities predominantly relate to the UK P&I Club.

-

The appointments are pending regulatory approval.

-

Miller recently strengthened its reinsurance proposition with the acquisition of AHJ.

-

The company has also promoted Alex Baker and Tim Duffin.

-

The start-up has hired four people to join the division.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

Phil Furlong has been made head of underwriting and oversight, a newly created role.

-

Logue replaces Richard Barke, who is moving to a senior leadership role at Asta owner Davies.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

William Soares moves from casualty and specialty CUO to president.

-

The campaign will run throughout June.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Chris Jones told this publication his plans for the first six months of his tenure.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

This year is predicted to be an above-average season, like 2024.

-

The $2.59bn renewal is up 45% from last year.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

The company also has $100mn for US hurricane events.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

What’s next for Conduit Re’s strategy following a leadership shake-up?

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

LA wildfire losses are impacting the 2024 years of account, Argenta noted.

-

The change reflects the company’s growing profile within the MS&AD group.

-

The executive will also continue as MD overseeing Caribbean fac.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Spicer will transition to a global specialty executive chairman role.

-

She will continue to work with the executive team on key projects and initiatives.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The executive will take the global role alongside his existing US responsibilities.

-

TMK formed its specialty reinsurance unit last year.

-

The underwriter joined Catlin in 2006.

-

Vincent Hermenier joined Hannover Re in 2004.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The reinsurer reported EUR2.1bn GWP for the year.

-

The company’s parent MS&AD reported group profit of 691bn yen for the year.

-

The carrier benefited from top-line growth and lower adverse PYD.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

Competition is high in specialty reinsurance as new capacity enters the market.

-

Specialty reinsurance has experienced high competition for talent.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

Renewable retrospective solutions were a key point during the discussion.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

The new CEO said recent purchases were designed to protect earnings volatility.

-

The CEO said Ascot would deploy capital where it sees opportunities.

-

New CEO Eckert said Conduit had taken “decisive action” after the LA wildfires.

-

Neil Eckert has been chair since the carrier was founded.

-

The headcount at the start-up now stands at around 40.

-

The market has broadened its risk appetite and infrastructure over the years.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The firm expects to replace the volume with Innovations-channel business.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

Hamilton also expects rising demand and stable supply for 1 June renewals.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

Q1 adverse reserve development went down to $4.2mn from $5.4mn a year ago.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

Till Wagner and Felix Rollin have been named executive board members in Germany.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

The carrier booked LA wildfire losses of EUR148mn.

-

The executive was previously a top US casualty broker.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

Meanwhile, gross written premiums grew 8.6% year on year to $985mn.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

Joanne Barry will be joining the team at Zurich.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The remediation process is on track for completion in the fourth quarter.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The executive also addressed the impact of the US tariffs.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The carrier reported a 3% price reduction across London market business.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

The group reported “robust” growth in property reinsurance premium.

-

The group reported a 19.1% return on opening adjusted tangible book.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The broker said the burgeoning class of business was still finding its stride.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Ann Field, Matt Moore and David Griffiths have also had promotions.

-

The underwriter left Antares last autumn.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

The California wildfires were the only “relevant event” for the period, the carrier said.

-

The firm said supply and demand was becoming more in balance than at 1 January renewals.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

The only major product line to see rate increases was casualty.

-

Combating depressed trading on the LSE and a delayed hard market shift has held back the firm.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The property segment experienced a 113.5-point impact from the California wildfires.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Insolvencies caused by the tariffs could also cause increased losses

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The combined business volume of the two firms is CHF20.1bn.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Insured losses were the second highest on record for the first quarter.

-

Fully placed, this would equate to $275mn on the per-occurrence tower and $675mn on agg.

-

Representatives from the UK broker have been ordered to appear before magistrates on 7 May.

-

Why have reinsurance start-ups remained so rare in recent years, even as underwriting conditions have improved?

-

Being the “new kid” has created interest in the market, Mereo CEO Croom-Johnson added.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

Chris Gray joins from Axis, where he was global head of marine reinsurance.

-

Judith Zeleny brings over 35 years’ experience to the role.

-

Due diligence is essential to make sure incubators are backing winners.

-

Alex Amezquita will fill Cahill’s previous position as CFO.

-

Trevor Oates will be responsible for ceded reinsurance purchasing.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

TMK is the largest insurer of aviation risks at Lloyd’s by gross written premium.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

ASR launched Syndicate 2454 at Lloyd’s last year.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

The prediction comes after a highly active hurricane season in 2024.

-

Modified freehold gives syndicates and investors clarity around exit plans.

-

The combined ratio improved by 1.9 points to 94.7%.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The process for the legacy book is believed to be in the late stages.

-

Growth was driven by Lloyd’s Syndicate 1274 and Antares Re.

-

The group is expecting to announce more M&A deals this year.

-

Gallagher Re’s global head of retrospective solutions, James Dickerson, recently exited.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The Bermudian legacy carrier is seeking a counterparty to manage the claims on the portfolio.

-

The 1 April renewals are the key date for Japanese treaty.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Caution around economic volatility wrought mixed outcomes in specialty re.

-

Michael Pickel retired from Hannover Re last year after 25 years with the reinsurer.

-

Conduit Holdings announced CEO Trevor Carvey’s retirement today.

-

The carrier has received 12,300 claims as of 28 March.

-

Analysts see Conduit’s extra reinsurance buying as a positive development.

-

Executive chair Neil Eckert will step in as interim CEO.

-

The shares will be purchased via the open market or private third-party transactions.

-

Reinsurers fended off 20% cuts, but wildfires pleas failed to hold pricing flat.

-

Reported income for the year rose 24% to $1.98bn.

-

The executive has managed both casualty and personal lines reinsurance books.

-

The executive, Everest CEO from 1994 to 2013, has served as board chair since 1994.

-

Sources said Insurance Advisory Partners is advising the fac MGA on the strategic process.

-

The rating allows IQUW to access $1bn in group capital.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Cat losses from Helene, Milton and the Oklahoma tornadoes will fall within expectations.

-

The syndicate expects to book a combined loss of £39mn from hurricanes Helene and Milton.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The syndicate achieved a profit despite a “relatively heavy” catastrophe year.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

The broker said that businesses not investing in AI capabilities would be left behind.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.