-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Solutions are being used to fill the gap left by traditional agg markets.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

The country's competition commission said the takeover would result in less competition.

-

The highest portion of losses was experienced in Alberta.

-

Expectations that reductions would cap out at low double digits are fading due to capacity oversupply.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

China Taiping has been identified as the building owner’s insurer.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

After a challenging period, the industry is now earning above its cost of capital.

-

The French mutual is one of the first major 1.1 accounts to firm-order.

-

Existing facilities and carrier partners will be transferring from K2.

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

The reinsurer said discipline was now “equally important as price”.

-

The reinsurer is “well on track” to achieve $4.4bn in net income for the full year.

-

P&C GWP grew by 7.1% to EUR26.8bn over the period.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

On a net basis, premiums written were up 4.7% to $641.3mn.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Cyber, mortgage and crop were identified as attractive growth areas.

-

The carrier said nat-cat losses remained “well below” those of prior years.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

Widespread underinsurance and low exposures will limit losses.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

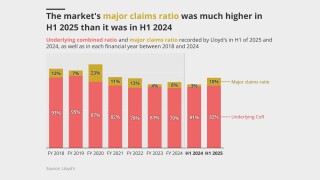

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Improved performance and growing investment returns played a role in the upgrade.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

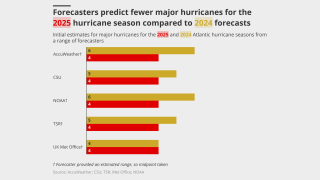

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The economic loss from the event was around EUR7.6bn.

-

The move comes as the broker rebuilds its Bermuda team.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The business said it was experiencing strong momentum on the Island.

-

Losses were primarily driven by personal property lines.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

Maintaining underwriting discipline was central to the Corporation's messaging.

-

The executive most recently served as head of North American treaty reinsurance.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The group claims the White House is undermining disaster preparedness.

-

The Bermudian reiterated its pledge to improve performance.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

The forecast has increased since the early July update due to several additional factors.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The French carrier’s first-half revenues were driven by 6% growth in P&C.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

US events accounted for more than 90% of global insured losses.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The weather-modelling agency is predicting a below-normal season.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

The company said the reduction was due to years of steady improvements.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

This year is predicted to be an above-average season, like 2024.

-

The $2.59bn renewal is up 45% from last year.

-

The company also has $100mn for US hurricane events.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

The new CEO said recent purchases were designed to protect earnings volatility.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Q1 adverse reserve development went down to $4.2mn from $5.4mn a year ago.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

The group reported “robust” growth in property reinsurance premium.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

The California wildfires were the only “relevant event” for the period, the carrier said.

-

The property segment experienced a 113.5-point impact from the California wildfires.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

Fully placed, this would equate to $275mn on the per-occurrence tower and $675mn on agg.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

Trevor Oates will be responsible for ceded reinsurance purchasing.

-

TMK is the largest insurer of aviation risks at Lloyd’s by gross written premium.

-

ASR launched Syndicate 2454 at Lloyd’s last year.

-

The prediction comes after a highly active hurricane season in 2024.

-

The combined ratio improved by 1.9 points to 94.7%.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Caution around economic volatility wrought mixed outcomes in specialty re.

-

The carrier has received 12,300 claims as of 28 March.