-

The deal adds a forward-flow, giving Compre the option to reinsure additional future years.

-

Charlotte Pritchard is set to succeed Andrew Creed, effective 5 January.

-

The transaction is subject to regulatory approval.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

This publication revealed Volante was in talks with legacy players last month.

-

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers are rethinking the traditional renewal-rights model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

Volante launched Syndicate 1699 in 2021.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

Plus, the latest people moves and all the top news of the week.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The agreement is the second service contract the group has taken on.

-

Plus, the latest people moves and all the top news of the week.

-

Andrew Creed has been promoted to group president in addition to his role as group CFO.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Bridges had been at QBE for 17 years.

-

The take-private deal was announced in July 2024.

-

R&Q Gamma’s outstanding liabilities predominantly relate to the UK P&I Club.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

Renewable retrospective solutions were a key point during the discussion.

-

The market has broadened its risk appetite and infrastructure over the years.

-

Till Wagner and Felix Rollin have been named executive board members in Germany.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The group reported a 19.1% return on opening adjusted tangible book.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The process for the legacy book is believed to be in the late stages.

-

Gallagher Re’s global head of retrospective solutions, James Dickerson, recently exited.

-

The Bermudian legacy carrier is seeking a counterparty to manage the claims on the portfolio.

-

Dickerson has spent over three years at the reinsurance broker.

-

Hampden embarked on a new “intelligent follow” strategy in 2023.

-

The reinsurance to close transaction is effective from 1 January 2025.

-

The second half of the year was significantly more active for the legacy market.

-

The restructuring arrangement is designed to protect creditors.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

Augment has been building its staff base after launching with Altamont backing in 2023.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The result was impacted by recent adverse development on a liability portfolio.

-

The transaction has received all required regulatory approvals and closed.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

RiverStone is assuming $1.2bn of a $1.6bn legacy deal.

-

The Corporation’s CUO said managing agents must ensure they manage the future differently to the past.

-

The UK subsidiary of Carrick will acquire BMS International Insurance DAC and Seamair Insurance DAC.

-

Future deal flow in the US could come from more adequately reserved liability lines.

-

The take-private is expected to close by mid-2025.

-

Hundle & Partners will provide capital support for the business, which will focus on acquiring corporate liabilities.

-

Sources said the venture will look to service both US and European corporates and is backed by family office money.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The transactions will de-risk all North America middle-market reserves up to 30 June 2024.

-

This is Carrick’s second transaction this year and Insurance Insider understands it expects to complete others before year end.

-

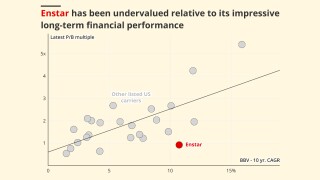

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

She will work on preparations for the take-private deal with Sixth Street before departing.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The executive replaces interim CEO Paul Brockman, who remains group COO.

-

Acquirers are increasingly discerning around deals, according to a report.

-

Plus the latest people moves and all the top news of the week.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

The transaction is conditional to the completion of the sale of shares in Accredited to Onex.