Karen Clark & Company

-

Increased vegetation could spell trouble in the future.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

Karen Clark & Company said the majority of insured losses will incur from US wind and storm surge damage, apart from just under $5mn which was attributed to winds across the Caribbean.

-

The latest estimates peg the fires as the second largest loss event in the state’s history, second only to Hurricane Iniki in 1992.

-

Insurance Insider has gathered data on geographical areas prone to cat events, which are outside of southeastern US states, that keep weather experts awake at night.

-

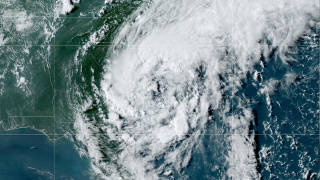

The modelling firm noted a shift towards stronger hurricanes making landfall.

-

The modeler warned that climate change was increasing the chances of $20bn, $30bn and $40bn loss events.

-

Climate change is likely to have already driven up insured losses from hurricanes by 11%, and could raise annual windstorm losses by an additional 10%-19%, according to the latest white paper from Karen Clark & Co (KCC).

-

The storm was the earliest named E storm, forming nearly six weeks earlier than average.