Issues

-

Lockton Re has leveraged long-standing client and market relationships to get its burgeoning fac business moving, despite the challenges of global lockdown

-

Brit has appointed Andrew Umphress as vice president, terrorism, for its US specialty operation, Brit Global Specialty USA

-

The aviation market has had a turbulent few years, but despite coronavirus-related loss of premium income in 2020, continuing rate increases into 2021 could keep it on track to profitability

-

Axa XL has received approval to set up a reinsurance subsidiary in China, making it the first foreign-owned reinsurance subsidiary in China.

-

S&P Global Ratings has revised its ratings outlook on Allianz Global Corporate & Specialty (AGCS) from stable to negative, citing Covid-19-related profitability concerns.

-

Insurers involved in the Financial Conduct Authority (FCA)’s test case for BI disputes have contested the regulator’s assertion that the Covid-19 outbreak was the proximate cause of insureds’ losses.

-

There has been a spate of claims in the cannabis insurance market after riots and looting broke out in many US cities earlier this month, according to broking sources.

-

Pacific Gas and Electric Company (PG&E) has received approval from the California bankruptcy court for an $11bn settlement with insurers related to wildfire losses in 2017 and 2018.

-

Insured losses for 2020 could make it the largest year for claims in history, according to Guy Carpenter, with losses totalling $160bn in the broker’s worst-case scenario.

-

A $49mn marine liability policy held by supply ship operator Rodi Marine is expected to be one of the first in the market to receive a Covid-19-related claim.

-

The directors’ and officers’ (D&O) insurance market is bracing for a total loss of around $600mn for claims against American-Israeli drug manufacturer Teva Pharmaceuticals.

-

The loss from a March explosion at a South Korean petrochemical plant has expanded from about $200mn to around $600mn after business interruption (BI) claims pushed up the initial loss estimate.

-

Argo Group has exited the SME cyber market, leading to the departure of senior underwriter and group head of cyber Paul Miskovich from the carrier.

-

The Hiscox Action Group (HAG) has been given permission to take part in the Financial Conduct Authority (FCA)’s test case on Covid-19 business interruption (BI) claims.

-

The All England Lawn Tennis & Croquet Club (AELTC)’s contingency policy is unlikely to renew next year due to market constraints, according to the CEO in charge of the Wimbledon tennis tournament.

-

Vanessa Macdonald-Smith, who resigned as CEO of the legacy JLT Fac business in April 2019, has resurfaced in the market as head of direct and facultative at Oneglobal Broking.

-

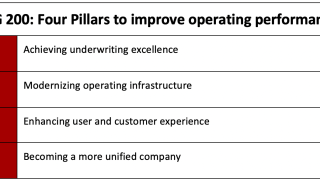

Allianz Global Corporate & Specialty (AGCS) CEO Joachim Müller has unveiled a turnaround plan that will make the carrier “more efficient, leaner and faster”.

-

Insurance lawyers are anticipating a massive surge in PTSD-related claims in the aftermath of the Covid-19 outbreak, amid a wider uptick in liability claims triggered by the pandemic.

-

A trend of capacity withdrawals from the accident and health market preceding the Covid-19 outbreak has been compounded by a growing pushback on pricing and terms and conditions following the pandemic.

-

Insurers for BW Offshore’s Sendje Berge FPSO may have dodged a bullet following a pirate attack on the vessel, but the ordeal may only be beginning for the nine crew members kidnapped in the raid.

-

Estimates from Aon, Munich Re, Swiss Re and Willis Re put Typhoon Hagibis lower than the modelled average, with Typhoon Faxai in line with expectations.

-

Inside P&C questions whether emerging pressures in medmal are receiving enough attention.

-

If early reporters Travelers and RLI are reliable cross-industry bellwethers, it looks like significantly lower overall catastrophe losses last year will flatter carriers’ Q4 and 2019 results and offset much of the damage from spiralling casualty claims.

-

Modest acceleration in January brings underwriter hopes of further momentum mid-year.

-

The World Bank's pandemic insurance bond covers the virus, and is designed to trigger if deaths impact multiple nations.

-

However, there's more to re-underwriting an excess book than price alone, Inside P&C analysts noted.

-

Only a matter of months ago “social inflation” sounded slightly arcane. It has since become the industry’s main preoccupation.

-

The cutbacks could have withdrawn close to $1.5bn of limit from the market.

-

Discussions about the programme's roll-out reveal fears of accidental coverage widening and a flight by insureds to companies markets.

-

This publication looks at the 10 most prevalent industry trends for the year ahead.

-

As much of the western business world last week battled post-Christmas inertia, regulators at the UK’s FCA were already hard at it.

-

Pricing continued to rise at 1 January amid a capacity squeeze and social inflation.

-

Speculation linking AIG with a bid for Voya highlights the competing operating and capital allocation challenges facing company in 2020.

-

The private fundraise offsets shrinkage in the ILS firm's two mutual funds which invest in cat bonds and sidecars.

-

Neon closure brings total number of shuttered syndicates since 2018 to eight.

-

The regulator’s proposals go further than Eiopa’s planned cloud-focused reforms.

-

An oil rig off the coast of Norway may seem an unlikely victim of social inflation. But the phenomenon that has created misery for USA Inc and shaped the outcome of the casualty reinsurance renewals is being felt far from the pharmaceuticals companies, the hospitals, the religious institutions – and insurers thereof – perceived to stand well ahead in the firing line.

-

Blazes not expected to breach occurrence retentions despite generous hours clauses.

-

Leo Re sits alongside Munich Re's more broadly distributed Eden Re, which contributed $300mn in 2019.

-

The majority of I50 stocks rallied during 2019, enabling the index to grow by almost 20 percent.

-

Willis Re report shows reinsurers reacting to Boeing incidents and ILS lock-up.

-

A shift towards rated paper and occurrence structures helped the market clear with some deals remaining outstanding.

-

The Insurance Insider looks back to some of the standout pieces of the last 12 months.

-

Rates on North American property binders up between 10 and 25 percent depending on territory.

-

This publication explores growth by quartile and the biggest risers and fallers in the market.

-

The main disrupted segments are still aggregate retro and sidecar vehicles.

-

For major continental European (re)insurers the three-year strategic plan, preferably with an aspirational moniker and definitely all capped up, has become a key benchmark of performance.

-

Two professionals win the underwriter rankings and RKH Specialty’s Jason Rose climbs to the top of the broker podium.

-

An ever-clearer picture is emerging of what winning and losing looks like in a hardening market.

-

Sources said airline premiums have increased by around 40 percent on average.

-

Just as the major UK political parties brawling to form the next government have decided voters are unmoved by the boring business of debt- and deficit-to-GDP ratios, Swiss Re CEO Christian Mumenthaler has concluded that capital concerns no longer hold that much sway.

-

The (re)insurance industry argues that the cumulative impact of rules disadvantages the UK compared with peers.

-

The carrier has dropped some layers from its ILW-based ILS transaction.

-

A-grade students lose momentum, world-class soccer teams have bad runs and every ship must occasionally navigate through stormy weather.

-

The new conduct and governance regime will significantly increase regulatory requirements for brokers from next week.

-

Buyers look to alternative risk transfer options as stressed market conditions continue.

-

Data from the Q3 CIAB pricing survey provides solid evidence the market today is well beyond anything seen since the turn of the decade.

-

The reinsurer said it had it ceded $900mn more exposure overall into the alternative reinsurance market in 2019.

-

Is light finally at the end of the tunnel for Swiss Re Corporate Solutions?

-

Loss deterioration, interest rates and capacity reduction lend weight to reinsurers’ case for rate rises.

-

This publication highlights five key areas of the unit’s turnaround plan from Swiss Re’s investor day.

-

The reinsurance chief also says he’s preparing clients for significant rate rises as the carrier’s underwriting “walks the talk”.

-

Cat bonds sponsored by the California Earthquake Authority and the Philippines government both achieved their target size while pricing in the upper range of coupon guidance.

-

International CEO Vandendael predicts staff numbers in London and Dublin will rise by about a quarter in 2020.

-

Any carrier troubled in recent months by large losses, be they property or casualty, will have noted Zurich CEO Mario Greco’s claim last week that his company has neutralised the threat.

-

The Corporation said it would lobby regulators and tax authorities to deliver an effective structure.

-

One of the best indicators of risk is how much growth was written in problematic lines during the soft market years.

-

The business was established as a JV by Willis and Pembroke in 2012 after change in Lloyd’s rules.

-

The mooted lead-follow arrangement was another bone of contention.

-

Full syndicates approved in the five-year period have generally underperformed.

-

Inside P&C analysts applaud loss ratio improvement but note there is more work to be done on expenses and capital efficiency.

-

Casualty rates and T&Cs should improve for 24-36 months, the executive said.

-

The four European carriers have significantly outpaced Bermudian reinsurers in GWP growth so far this year.

-

The latest Galileo cat bond has five tranches and will cover various natural catastrophe risks in the US, Canada, Puerto Rico and the US Virgin Islands, Europe and Australia.

-

Executives who have been upfront about the need to batten down the hatches ahead of the impending casualty storm must be feeling a little put upon.

-

The Hyperion X analytics head said the process would be “painful and nerve-wracking” but would enable more trading opportunities.

-

As claims from Dorian and Faxai dent Q3 results, this publication assesses the impact on the market so far.

-

Travelers chairman and CEO Alan Schnitzer is a vocal critic of a US litigation culture he claims imposes a “tax across society”. A worsening tort environment was the driving factor in the carrier’s own quarterly earnings shortfall, and has also emerged as key theme of the third quarter reporting period.

-

After years of cheap capacity and widening terms, complex accounts renewing in recent weeks have attracted low double-digit rate hikes.

-

AIG’s AlphaCat-managed ILS funds grew AuM by $200mn in Q3, while assets at Nephila, Hiscox ILS and Mt Logan dipped in the quarter.

-

Now is the time to prove the growth rationale behind the 2015 Ace-Chubb merger, Inside P&C analysts said.

-

A more litigious environment in the country has pushed up claims frequency and severity.

-

How was your company’s cloud “journey”? Was it redemptive, like the path from convicted criminal to TV talent show winner? Did you learn a lot about yourself in the process, and more importantly do you love the destination?

-

The report showed record levels of funding but also emerging geographies, a changing funding composition and renewed B2B focus.

-

Failing to expand could lead to the market stalling, suggested speakers at Trading Risk’s New York conference.

-

Rates are technically weak, but growth mindset and regional capacity will check pricing.

-

The government scheme is to back early-stage and growth capital investors participating in the UK's National Security Strategic Investment Fund.

-

The firm appears to be standing still on market share at best, according to an Inside P&C analysis.

-

The demise of Neil Woodford and his funds empire will have wide reverberations for many months.

-

The regional scene continues to mature, receiving more attention from foreign investors and InsurTechs alike.

-

The total return reinsurer is working with JP Morgan as it explores its options.

-

Cedants are also increasingly seeking for group-level reinsurance protection for cyber exposures.

-

Sister title Inside P&C gives an early view on the results commentary for Q3 earnings, which points to further acceleration.

-

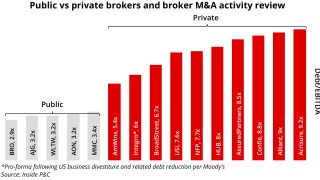

An Inside P&C analysis delves into the operating results of the 12 largest private brokers by revenue.

-

Rates and deductibles are increasing and wordings are under scrutiny as market reacts to losses.

-

Historic frequency and severity of losses will create sharp pressure for rate rises at 1 April.

-

The Dubai-based insurer is to be publicly listed following a $400mn deal with blank cheque vehicle Tiberius.

-

Geography matters in reinsurance. Bermuda's isolation means that every carrier knows its neighbour's business.

-

Investors may be able to part collateralise ILS investments with other assets, effectively adding an ILS overlay to an existing mandate, says Rick Pagnani, head of the firm’s ILS business.

-

Lloyd’s 2020 business planning season has begun and already we seem to have an answer to one of the market’s key questions as it looks to the year ahead.

-

Changes in leading positions point to a fluid market for cyber talent.

-

Tokio Marine is likely to retain a significant portion of Pure’s $666mn of 2018 ceded premium net.

-

The Insider 50 index has now reached its highest level since February this year.

-

Lloyd’s should be applauded for the blueprint it released to the market yesterday.

-

The Insurance Insider provides a breakdown summary of the most important points in the 145-page strategy blueprint.

-

I think it’s fair to say it’s been an interesting few weeks at Greenlight Re.

-

Brokers are lazy.

-

The underlying numbers suggest the market’s performance is still being held back by poor underwriting decisions of the past.

-

Further focus on disciplined underwriting and profitability means the stresses of recent months will remain.

-

The MS Amlin-owned ILS fund is speaking to Lloyd’s about new entry routes to the Corporation for open-ended ILS funds.

-

The Insurance Insider gives you a run-down of everything you need to know from the reinsurance conference.

-

The level of restructuring of coverage in the quarter and the breakdown of price increases by month point to a change in risk appetite.

-

How dare politicians lecture our industry on what constitutes good conduct?

-

The carrier would consider a vehicle if it allowed the matching of the right capital to risk, the Axa XL CEO said.

-

It felt a lot more restful heading off to Nice Airport this year than the last two, didn’t it?

-

AIR last week predicted up to $3bn in insured losses in the Caribbean from the storm.

-

The Insurance Insider lays bare the dynamics in the $4.5bn market in the wake of the MMC-JLT deal.

-

The relatively small number of participants has to date constrained the capital supply and pricing for Lloyd’s legacy deals.

-

The Insurance Insider takes a look at reinsurance market dynamics after “near-miss” Dorian.

-

Focus will initially be on claims processing and risk platforms, with the lead-follow distinction also in scope.

-

The world in which we live is increasingly measurable, and will only become more so over time.

-

2019 returns have recovered but until underlying conditions change more, new capital is not expected to flow in.

-

However, analysts said there was more capital waiting on the sidelines to enter the turning market.

-

August has been in no way tranquil for P&C stocks.

-

The CIAB methodology makes the survey headline numbers less interesting than they might appear.

-

An important distinction is emerging in the broker and MGA world that is driving a two-tier system of valuations.

-

Far from making interest rates great again, rates have returned to levels likely to make investment income grate on returns again.

-

Derivative actions and social inflation have created a significant uptick in claims activity.

-

The carrier’s current total of $2.1bn has grown from $300mn at the start of 2015 and is up $100mn since the start of the year.

-

In insurance we always think our worst clients are the ones who don’t really need us.

-

London sources reported positive pricing movement, but cautioned international markets pose a threat.

-

A benchmarking survey found the complexity of P&C products contributed to significant costs.

-

Is there anything more primal and satisfying than growing your own food?

-

More disciplined underwriting and increased submissions are driving rate in the property space.

-

The latest increase has pulled its cumulative returns since inception down to a loss of 52.9 percent for ordinary shares, as prior-year gains have been more than wiped out by 2017/18 disaster events.

-

One way to think about the ambitious build-out of start-up (re)insurer Convex is an interesting test of the franchise values of specialty (re)insurers.

-

I recently promised I would report back to you on a book I was looking forward to reading on holiday.

-

Under pressure from all sides, the first generation of total return vehicles appear to be getting less room to manoeuvre.

-

AIG took a $1mn investment loss from its $124mn holding in AlphaCat, whereas Pillar provided $3.3mn of investment income for Alleghany.

-

Swiss Re leads the charge on US exposure as reinsurers prepare for North American hurricane season.

-

Withdrawals from US inland marine, yacht and prison insurance follow a trend set in the London market.

-

The Insurance Insider takes a look at how Stephen Catlin and Paul Brand's plans for 2020 could impact the broader market.

-

Swiss Re’s medmal exit comes after ProAssurance’s warning last quarter of companies being “swept away by the tide”.

-

A third of the portfolio is targeted for remediation, as a shift towards third-party reinsurance purchasing is signalled.

-

The results showed a mixed bag for (re)insurer use of third-party capital.

-

With honourable exceptions, big generalist businesses with highly corporate cultures are bad acquirers of smaller, more specialised outfits with entrepreneurial mindsets.

-

The three Sunshine State carriers that reported earnings last week suffered operating losses in the quarter.

-

Pro forma analysis shows the combined gross written premium of Syndicates 2012 and 1955 to be £666mn.

-

Further details of the cyber placement show the risk is fairly evenly spread across the US, Bermuda and London markets.

-

Kinesis deployed 50 percent more limit year on year while RenaissanceRe grew its DaVinci sidecar.

-

The ILS market is passing through a period of real change as the landscape is reshaped following a highly challenging 18 months.

-

Claims inflation looks set to squeeze reserve releases and offset the impact of rate rises.

-

This publication highlights four major trends from the Willis Towers Watson Q2 InsurTech briefing.

-

Participants in The Insurance Insider’s 2019 technology roundtable said there was a danger of the sector over-engineering solutions.

-

At The Insurance Insider’s 2019 legacy roundtable, executives said holding the line on price would ensure the longevity and prosperity of the run-off market.

-

Lloyd’s top leadership team garners praise in survey of London One Hundred members.

-

Our director of research Gavin Davis and his team have been on tremendous form of late.

-

AuM as measured by Trading Risk was almost flat at $103bn, up fractionally on 1 January.

-

Insurers are looking to cover recent claims and prepare for potential losses.

-

It’s clear that pricing is improving. But how widespread is the pain that’s driving it? (It’s not just AIG & Lloyd’s)

-

The firm’s 2015 Atlas cat bond has triggered, following loss creep from the 2017 hurricanes.

-

A Financial Times interview with Pat Gallagher made me long for the summer break and the chance to read and digest a book I have been recommended.

-

The Insurance Insider’s Market Sentiment Survey, in association with EY, found that the majority of market figures think growth will be difficult to sustain.

-

They face a Herculean task but the two start-ups could break the stranglehold of MMC, Willis and AJG in the aviation market.

-

Financials show recent results driven by leverage and lower quality earnings improvement.

-

The manager invested more than $100mn less in the April fundraise for Swiss Re’s sidecar than last year.

-

The wholesale broking association’s CEO believes the Corporation’s revamp could restore reinsurance capital lost to rival centres.

-

Panellists at a Clyde & Co conference warn that a broadening array of climate change-related litigation will soon start affecting insurers.

-

Increased competition has made the class one of the few in EC3 that is not seeing a rating upswing.

-

The trouble with regulation is that its three main pillars – conduct, prudence and competition – are in a rock, paper, scissors relationship with each other.

-

Analysis shows the size of a Lloyd’s syndicate lacks alignment with acquisition expenses.

-

Broader wordings are creating systemic exposure and pushing up loss ratios.

-

The nature of partnerships between InsurTechs and incumbents is changing, according to attendees and speakers at the DIA Amsterdam conference.

-

Should insurers make moral judgements?

-

Axis and Swiss Re were able to top up on ILW cover at the lower end of their targeted costs.

-

AFG’s decision to retain the group looks like a bet on improved pricing and market transformation.

-

The P&C industry P/B multiple increased to 1.41x, the highest level since 2007.

-

Advisers and practitioners warn of an increase in “reverse #MeToo” complaints.

-

The Insurance Insider ran an analysis into syndicate administrative costs after Lloyd’s found no correlation between the size of a syndicate and its admin expense ratio.

-

Capital is returning to the ILS industry after the past two years of losses, Paul Schultz, CEO of Aon Securities, said at the firm’s 2019 ILS event last week.

-

It is easy for senior management to get so caught up in the minutiae of managing their businesses that they forget the importance of their company having a strong narrative.

-

Insurance sector experts called for broader diversity initiatives and suggested practical solutions at the third Insider Progress event.

-

Despite early hopes of sizeable rate rises, reinsurers are frustrated that many accounts will renew with as-before terms.

-

Markets behave in brutal and slightly crazy ways that don’t always best serve the end consumer. They always undershoot on the downside and then overshoot on the upside – sometimes hugely and irrationally so.

-

The withdrawal of US domestic capacity for big-ticket property risks continues to bear fruit for the London market.

-

New deals have brought total year-to-date ILS volumes to $2.9bn, pointing to a shrinking of the market.

-

Fast-track plan approval for some along with limited pre-emption approvals points to differentiation.

-

The US market also lags the wider industry in its level of female representation at the top.

-

A rule-of-thumb calculation suggests Boeing’s grounding liability sub-limit may already have been breached.

-

In elite sport the top coaches ration their finite resources to give their best athletes the greatest chance of success.

-

Pension fund and PE buy-in demonstrates insatiable appetite of private money for broking assets.

-

One of two executives is expected to replace Dominic Addesso when he steps down later this year.

-

Further M&A activity in the ILS market points to the likelihood that no single ownership model will prevail.

-

You will doubtless have seen the amazing but terrifying picture of a throng of climbers lining up patiently to make their ascent of the peak of Mount Everest doing the rounds of social media over the past few weeks.

-

Experts still forecast an average hurricane season.

-

“Green shoots” of rate firming spur hopes of further gains.

-

Preliminary data suggests the number of reported tornadoes in the quarter to date is the highest since 2011.

-

Only 11 percent of companies in our analysis have relatively equal representation on their boards.

-

Meanwhile, Canopius’ George Connell and Tysers' Charlie Skipworth-Button have emerged as rising stars.

-

The chances that the independently-owned US retailer will reassemble Towers Re London team are growing.

-

Argo’s Francesca Thomson, Lockton’s Ben Beebee and Willis’ Jessica Murphy claimed the rising star positions for 2019.

-

Scor chairman and CEO Denis Kessler said the Coriolis acquisition would help its ILS platform move into the top tier of the market.

-

The outcome of the proxy contest could be seen as a coup for the carrier, but questions over expense management and corporate governance persist.

-

We journalists are always being told we are too subjective and prone to bias.

-

Jebi loss creep hits Munich Re, Swiss Re and Scor.

-

TigerRisk has a mandate to run the process following its advisory work with Hamilton on the Pembroke acquisition.

-

InsiderTech London speakers call for a new mindset when it comes to data sharing.

-

Sister publication Inside P&C examines the first-quarter results from the US.

-

The Akibare Re bond will pay out to Mitsui Sumitomo, sister publication Trading Risk revealed.

-

Before rock survivor Ozzy Osbourne was fully rehabilitated and had his star re-cast via reality TV – that is to say at the end of the decade he had spent as a genuine has-been – he featured in a low-budget UK documentary looking at his extraordinary career.

-

The Q1 pricing report provides further evidence that carriers are pushing for rate and attempting to manage exposures as loss-cost trends bite.

-

Insureds are resisting rate rises after another loss-free year for offshore wind risks.

-

This publication highlights four major industry trends to come out of the Willis Towers Watson quarterly InsurTech Briefing.

-

After the KRW storms of 2005, I remember interviewing a top reinsurance broker and making the casual remark that the major spike in property cat pricing must be making his bosses very happy. I envisioned bulging brokerage accounts and big bonuses all round at year end.

-

Centralised R&D, remote syndicates, max outsourcing, a 10 percent expense ratio and insurance as an asset class.

-

First-quarter combined ratios deteriorated at most Bermuda-based (re)insurers.