Interviews

-

The syndicate will be managed by Polo Managing Agency.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

One critical sticking point for Lloyd’s is the true alignment of interest with the market.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

The aviation specialist is eyeing up diversifying into new classes such as marine.

-

Better data validation and stronger claims controls are also key for MGAs.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

The executive said that outside of property cat, renewals will be “relatively stable”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

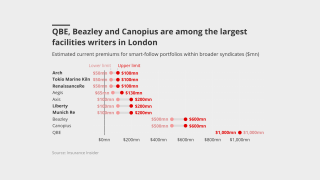

The CEO said smart-follow is a structural evolution of the specialty market.

-

Regulators do too little to distinguish between generalists and specialists, he said.

-

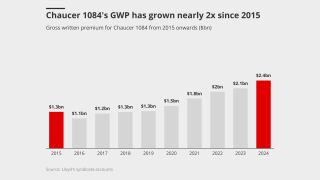

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months. In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The executive said claims can be a differentiator in a softening market.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

The carrier booked top-line growth of 2% in H1.

-

The family-owned group is embarking on a major international expansion.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The company has also expanded its relationships with US and UK MGAs.

-

The CEO said business remains adequately priced in most classes.

-

The firm is currently working with 13 MGAs, including QMetric and Eaton Gate.

-

The insurer is weighing up options including entering new geographies and M&A.

-

A second syndicate is being explored for “big and bold” new lines

-

The executive said there was an ‘active cross-sell culture’ across The Fidelis Partnership.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The executive said the MGA model is here to stay and offers an “immense value”.

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.