Interviews

-

The data available can “help to inform” a carrier’s strategy in the open market.

-

The syndicate will be managed by Polo Managing Agency.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

One critical sticking point for Lloyd’s is the true alignment of interest with the market.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

The aviation specialist is eyeing up diversifying into new classes such as marine.

-

Better data validation and stronger claims controls are also key for MGAs.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

The executive said that outside of property cat, renewals will be “relatively stable”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

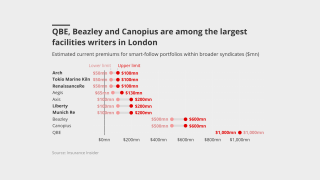

The CEO said smart-follow is a structural evolution of the specialty market.

-

Regulators do too little to distinguish between generalists and specialists, he said.

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months. In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.