Insurers

-

Most Covid BI claims are due to lapse in March 2026.

-

The company said the move was a key part of its risk-diversification strategy.

-

Savannah Thompson resigned from TFP, where she had been since 2017.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

The company named two execs to head global wholesale and commercial.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

Ackman targets high-teens ROE at Vantage via underwriting gains and equity investing.

-

The deal follows a minority investment from the insurer in the summer.

-

Savannah Thompson is set to exit after eight years with the company.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

-

The newly created role will have responsibility for algorithmic and digital distribution channels.

-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

Nick Hankin replaces Chris Killourhy, who is becoming group CFO.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

At present, Mosaic Syndicate 1609 is managed by Asta.

-

The data available can “help to inform” a carrier’s strategy in the open market.

-

The country's competition commission said the takeover would result in less competition.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

Canopius will continue to be one of several capacity providers to the MGA.

-

The highest portion of losses was experienced in Alberta.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Expectations that reductions would cap out at low double digits are fading due to capacity oversupply.

-

The executive co-led the US financial institutions business at BHSI.

-

The marine insurer said a volatile claims environment necessitated rate adjustments.

-

BNP Paribas will take a EUR1.11bn stake in Ageas.

-

The mechanism would work similarly to Flood Re.

-

According to the Civil Unrest Index, protest activity has soared over the past two years.

-

The Lloyd’s Market Association (LMA), setting out its “core asks” for 2026, has said it is expecting the market to achieve multiple peer-to-peer technology adoptions next year.

-

The underwriter is set to leave the business after 20 years.

-

McGill’s Underscore platform will identify eligible risks for Aegis to follow.

-

Smaller syndicates are lifting their share of the market, as the top quartile also returned to growth.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Six of the 10 largest syndicates remained flat or reported de-emptions.

-

Lower rates and currency shifts have pushed syndicates to cut stamp.

-

Jaymin Patel joined Berkley Specialty London in 2021 as senior engineering underwriter.

-

The carrier booked GWP growth of 6% for the first nine months of 2025.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

In mid-morning training, the share price had fallen by 12%.

-

The underwriter will fill a newly created role at AIG.

-

In this final instalment, we argue that investing in personnel is as critical to success as the tech itself.

-

Call for public and private partnership in cyber are not new, but sentiment remains divided.

-

Rob Sage joined Aon in 2022 as an executive director.

-

The association has teamed up with Lloyd’s on a women’s underwriting summit.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

In 2024, Aviva agreed to buy Direct Line for £3.7bn, which led its risk-adjusted capital score to fall.

-

The peril has been historically difficult to model compared to others.

-

Plus, the latest people moves and all the top news of the week.

-

Habayeb will start next May following Kociancic's retirement.

-

Aegis, Beazley and others are among those cutting stamps.

-

Emma Woolley has held the marine role on an interim basis alongside running Talbot.

-

At our London conference, executives saw various routes to growth, even as headwinds grow.

-

Sharp will remain for the 2026 renewal process, before pursuing a new opportunity in the market.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Executives also agreed that facilitisation is a structural market change.

-

MassMutual will retain an 82% stake in the $470bn asset manager.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The carrier now expects to deliver full-year operating profit of ~£2.2bn.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

The power market is experiencing double-digit rate reductions.

-

The move to launch a second syndicate was reported by Insurance Insider in June.

-

Carriers must position themselves as underwriting bifurcates.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The underwriter departed Allianz earlier this year.

-

The sector’s recent achievements have flown below the radar, despite huge value creation.

-

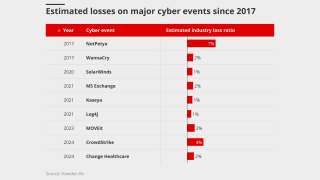

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The charity said that improved ecosystems could help protect from disasters.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

The loss would be one of the largest ever for mining underwriters.

-

The June 2024 ransomware attack produced claims across many firms.

-

The consortium will target excess layers, providing $250mn of capacity.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

The CEO said smart-follow is a structural evolution of the specialty market.

-

Widespread underinsurance and low exposures will limit losses.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

This publication revealed the move earlier this year.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The carrier recently expanded its reinsurance product suite in Bermuda.

-

The number of syndicates traded at auction was the highest for a decade.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The carrier is looking to achieve sustainable growth across its personal lines business.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The two lines will add £11mn in planned premium.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

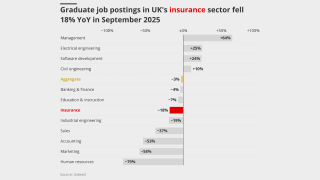

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.