-

In Partnership With ArchPushing 1 January renewals late in the season can undermine outcomes, said Maamoun Rajeh, President, Arch Capital Group. During an interview at the PwC Insurance Summit, Rajeh called for a bifurcated market approach combining strategic partnerships and a collaborative price discovery process months before renewals.

-

In Partnership With SiriusPointDuring an interview at the PwC Insurance Summit, SiriusPoint CEO Scott Egan highlighted the danger of pricing cycles. As pressure mounts after a quiet cat quarter, he urged reinsurers not to create pricing cycles by chasing volume at the expense of long-term industry attractiveness and risk adequacy.

-

In Partnership With PwCPwC Partner Matt Britten predicts a wave of dealmaking in 2026, driven by diversified third-party capital from hedge funds, private equity and more. With reinsurers seeking growth and new asset classes emerging, the market is set for increased activity and innovation, he said during an interview at PwC's Insurance Summit.

-

In Partnership With PwCAn expected $600bn of capital flowing into the financial services industry in the coming years is focused on innovation and can reshape the insurance industry, said Arthur Wightman, territory leader, PwC Bermuda, during an interview at PwC's Insurance Summit.

-

In Partnership With AonThe continued growth in cat bonds and third-party investment brings new options for risk transfer, diversifies investor pools and boosts returns, said Andy Marcell, CEO, Aon Global Solutions, during an interview at the PwC Insurance Summit.

-

In Partnership With Aspen"We don't want to run away from that risk. We want to run to the risk as long as we can quantify it," said Christian Dunleavy, President, Aspen, during an interview at the PwC Insurance Summit.

-

In Partnership With Ren Re"We are unique in that for every line of business we write, we have both an owned balance sheet and a third-party capital solution to bring to customers," RenaissanceRe CEO Kevin O'Donnell said during an interview at the PwC Insurance Summit in Bermuda.

-

In Partnership With Gallagher ReReinsurance investments surged past 50 deals in Q3, Freddie Scarratt, Global Deputy Head of InsurTech, Gallagher Re, said during an interview at the PwC Insurance Summit in Bermuda. He said 75% of the deals were AI-driven.

-

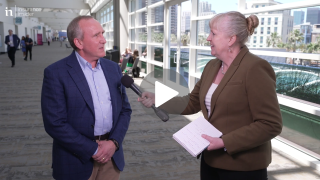

In Partnership With MSIG USAOver the next six to eight months, MSIG USA will continue its US expansion with new hires and new products, including launching cyber coverage, said Peter McKenna, CEO of MSIG USA, at RISKWORLD in San Diego.

-

In Partnership With Munich ReHeading into hurricane season, the property insurance market continues to face the impact of inflation and severe convective storms, said Martin Neuhaus, president, Munich Re Facultative & Corporate North America at RISKWORLD in San Diego.

-

In Partnership With MarkelBusinesses are looking for comprehensive, specialized product and service solutions in addition to indemnity coverage, said Kristin Towse, executive underwriting officer, Markel Specialty, at RISKWORLD in San Diego.

-

It’s critical that insurers help clients to evolve and manage new and different risks stemming from AI, said Lucy Pilko, CEO of the Americas for AXA XL at RISKWORLD in San Diego.

-

Data tools are helping businesses better understand and manage risk beyond just buying insurance, said John Merkovsky, global head of risk and analytics, WTW, at RISKWORLD in San Diego.

-

Growth in the E&S market is expected to continue, as risks are continuing to become more complex and difficult to place in the admitted market, said Adrian Cox, CEO, of Beazley at RISKWORLD in San Diego.

-

Businesses that have faced multiple years of rate increases are finding relief through innovative solutions including captives and telematics, said Mo Tooker, head of commercial lines, The Hartford, at RISKWORLD in San Diego.

-

E&S has thrived around innovation and will continue to grow in 2024 and 2025, said Chris Sparro, CEO of North America, Sompo Commercial and P&C Insurance at RISKWORLD in San Diego.

-

Insureds are finding relief from hard market cycles by turning to captives and self-insurance, said Katie McGrath, CEO North America Swiss Re Corporate Solutions at RISKWORLD in San Diego.

-

Cyber attacks are increasing and becoming more complex, and large companies are facing more attacks, said Mario Vitale, president, Resilience at RISKWORLD in San Diego.

-

A survey of 600 CFOs found cyber security, macroeconomic pressures, geopolitical risk, and talent acquisition and retention were key concerns among CFOs, said Joan Woodward, president, Travelers Institute.

-

From transactional insurance to traditional property and casualty insurance, the active private equity space is seeking more complex and bespoke insurance, said Seth Gillston, private equity industry practice leader, Chubb at RISKWORLD in San Diego.

-

Zurich North America is collaborating with other industry leaders to educate defense attorneys, said Keith Daly, chief claims officer, Zurich North America.

-

In Partnership With RIMSIn conversation with Gary LaBranche, RIMS CEO

-

Bob Forness, Chief Executive Officer, MultiStrat, says collateralized casualty reinsurance is expanding to offer multi-program facilities for MGA aggregators, carriers and brokers. It can also evolve to offer both retrospective and prospective cover, he says.

-

After three years of downward pressure on pricing, demand for Directors & Officers liability insurance is rising this year, leading to a flattening of the market in 2024, says Tim Usher Jones, Founder and CEO at Banyan Risk Ltd.

Most Recent

-

In Partnership With AXIS

-

-

In Partnership with Allianz

-

-

In Partnership with Falvey Insurance Group

-

-

-

In Partnership With M&A Services

-

In Partnership with Allianz