Inigo

-

What does it take to build a reinsurer that can manage volatility?

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The deal will be watched closely by Radian’s handful of similar peers.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Plus, the latest people moves and all the top news of the week.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

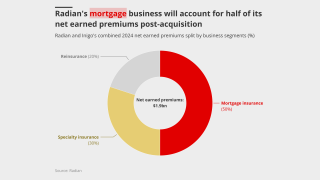

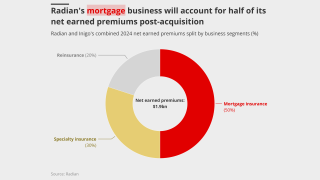

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The post-disaster reinsurance start-up model is changing.

-

Motion Specialty will initially focus on high value home and flood insurance in the US.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

Followers will automatically support primary or excess Inigo quotes.

-

The business will test the market from a position of strength after impressive early profits and robust growth.

-

The Lloyd’s (re)insurer is looking to execute a five-year plan to double GWP to $3bn.

-

Axa XL has also added Fidelis’ Jamie Cann to its aviation team.

-

The carrier is also considering a potential casualty treaty market entry.

-

Listen in as Inigo CEO Richard Watson and head of reinsurance Alice Kaye discuss the use of data and AI in underwriting, the possibilities of entering the casualty treaty market, and all options being on the table for future capital events.

-

The carrier increased its top line by 35% to $1.1bn.

-

-

Harker was previously global chairman and CEO of Marsh Aviation.

-

Cyber will be the only line Inigo enters this year after pushing into several new lines last year, including FI, aviation war and onshore energy.