Florida

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

She previously served as Hub’s North American casualty practice leader.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

The executive will oversee Howden Re’s treaty and fac business in Miami.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The MGA is offering lines of $25mn, up from the $10mn limit it was providing until late last year.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

The homeowners’ carrier has secured Floir approval.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The loss figure has increased 200% from the initial number provided in October.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

The carrier is looking at a $600-$900mn hit from hurricanes Debby, Helene and Milton.

-

Richard Mangion spent almost two years as CFO at Bridgehaven.

-

The firm still expects to deliver positive net income for Q3 2024.

-

The company said $13bn-$22bn will come from wind damage.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

RMS will issue its final loss estimates for Milton later this week.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

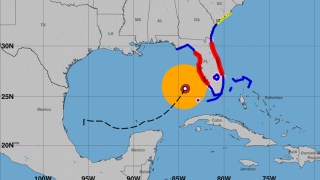

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

The cost to the NFIP is likely to be a “mid to high single-digit-billion impact”.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.