Emerging risks

-

After a challenging period, the industry is now earning above its cost of capital.

-

Panellists agreed a soft market should not dampen product development.

-

The executive said the market will be revolutionised by digital technology.

-

The charity said that improved ecosystems could help protect from disasters.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

Politically related exposures are growing for the marine market.

-

The broker called on carriers to expand coverage into new specialisms.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

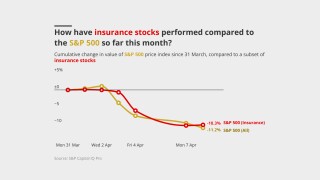

Are intermediaries facing tougher times as the broking supercycle winds down?

-

The group said corporations face geopolitical and climate risk.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

Insolvencies caused by the tariffs could also cause increased losses

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

The MGA’s US clients will now have access to London market capacity.