Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest Aviva news from Insurance Insider

Competitor news

What Your Competitors are Reading

Financial news

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

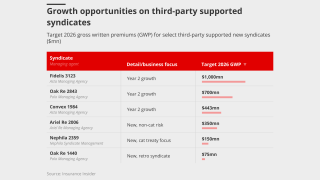

The syndicate is expected to write ~$300mn of business in 2026.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The number of syndicates traded at auction was the highest for a decade.

-

The carrier is looking to achieve sustainable growth across its personal lines business.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The company noted tougher market conditions and higher large losses during the year.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

Insider On Air: Our Webinars & Podcast Channel

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership with Moody'sJoin Insurance Insider for a free webinar, offered in partnership with Moody’s, at 10:30 EST/15:30 GMT on 22 January

-

In Partnership with Swiss ReThe global construction industry continues to expand, says Jimmy Keime, Head of Engineering and Nuclear, for Swiss Re.

-

In Partnership with Swiss ReAhead of the upcoming Baden-Baden Reinsurance Meeting, top of mind for many are climate, economy and geopolitics, says Nikhil da Victoria Lobo, Head of P and C Reinsurance for Western and Southern Europe and Middle East and Africa for Swiss Re.

From our other titles

From our other titles

From our other titles

From Insurance Insider ILS

Nephila’s Q3 ILS operating revenues up 21% YoY to $30.3mn

Operating revenues were also up on the $29.1mn reported over Q2.

From Insurance Insider ILS

RenaissanceRe AuM grows 7% to $7.5bn in Q3

Third-party investors made a net income of $415mn in the quarter.

From Insurance Insider US

‘We’re holding ourselves accountable’: CA insurance commissioner Lara

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

From Insurance Insider US

Claims frequency in physicians medmal starting to creep up: Doctors president

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

From Insurance Insider

CNA Hardy names Booth head of specialty as Berman departs

Ariel Berman joined the company as head of specialty in 2023.

From Insurance Insider US

Ascendex launches with plans for 5-7 programs in two years

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

Insurance Insider US provides robust insights, sharp analysis and exclusive news on the London and global (re)insurance markets.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.