Aspen

-

Innovation emerged as the critical target for attracting new business to London.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The Aspen exec highlighted the London market’s long-standing reputation for innovation.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

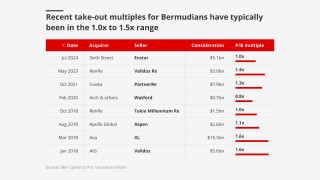

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Plus, the latest people moves and all the top news of the week.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Plus, the latest people moves and all the top news of the week.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The newly created role consolidates leadership across UK entities.

-

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

Emilie Hungenberg joins the carrier from Aspen.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

Plus, the latest people moves and all the top news of the week.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.