Asia Pacific

-

China Taiping has been identified as the building owner’s insurer.

-

The London-based MGA will begin underwriting its international book next month.

-

The carrier is currently focused on ~$1bn bolt-on acquisitions.

-

The carrier boosted net premiums by 45% and shaved 2 points off its expense ratio.

-

The improved combined ratio was driven by lower losses and expenses.

-

The international segment’s net written premium contracted 5%.

-

Stephenson will start his new role in early 2026.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

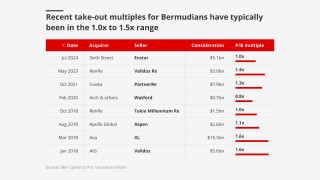

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

The underwriter has worked for Markel in Singapore since 2020.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The major storm is set to move on to mainland China later in the week.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

Candy Wong spent 30 years at Aon Re China before a stint at Guy Carpenter.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

The company has also opened a fac office in Singapore.

-

The carriers remain in takeover negotiations but have not reached a decision around valuation.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The expansive broker now employs over 450 people in Japan, after launching there in 2024.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The firm believes UK support for policyholders is under-served compared with the US.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The Japanese carrier noted the impact of increasing natural disasters.

-

Holmes, Froideval and Cheak will head up the units for London, Europe and Asia.

-

The syndicate-in-a-box is the first Lloyd’s syndicate to operate outside London.

-

The group reported “robust” growth in property reinsurance premium.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Caution around economic volatility wrought mixed outcomes in specialty re.

-

The merger is set for April 2027, subject to regulatory approval.

-

The event has caused widespread damage in Bangkok, Thailand.

-

Reinsurers fended off 20% cuts, but wildfires pleas failed to hold pricing flat.

-

The reinsurer anticipates downward rate pressure to continue over 2025.

-

Reinsurers’ hopes that LA wildfires will slow 1.4 softening are in question.

-

The two Asian companies wrote $265mn net premiums in 2024.

-

Cedants could choose to retain more as cross-share sell-offs boost their capital.

-

Reinsurers on portfolios with longer-tail liabilities may withdraw.

-

The council has begun gathering data to assess the insurance impact.

-

Behind Axa XL, Convex wrote a 9.5% line on the all-risks reinsurance programme.