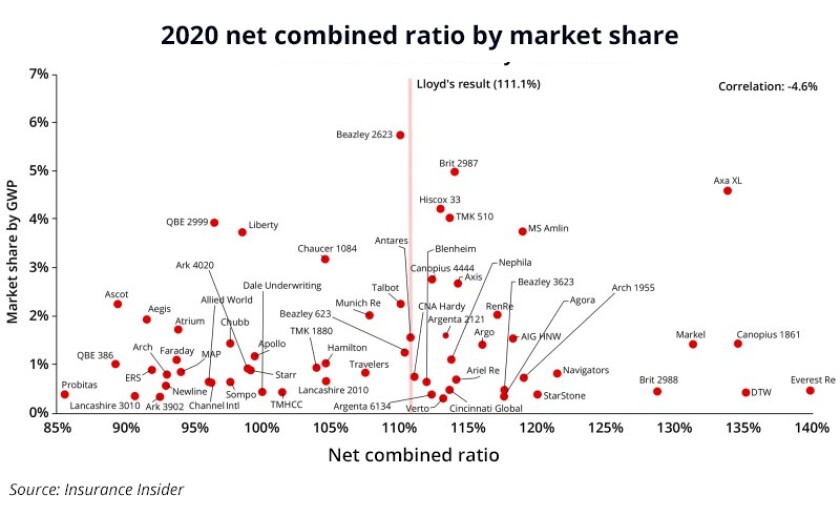

The size of a Lloyd’s syndicate by premium continues to have no influence on its underwriting performance, analysis by Insurance Insider has shown, challenging the received wisdom that size is a prerequisite to success at Lloyd’s.

In a re-run of a syndicate analysis first published last year, this publication plotted syndicates’ 2020 combined ratio against their market share of gross written premium (GWP) at Lloyd’s in the same year. The results showed practically no correlation (-4.6%) between the two variables.

For the purposes of this analysis, only syndicates with more than £100mn in annual GWP were used.

As with the 2019 results, the findings from this year’s exercise challenge the idea that syndicates need to build scale in order to find economies of scale and counterbalance the structural expense issues at Lloyd’s.

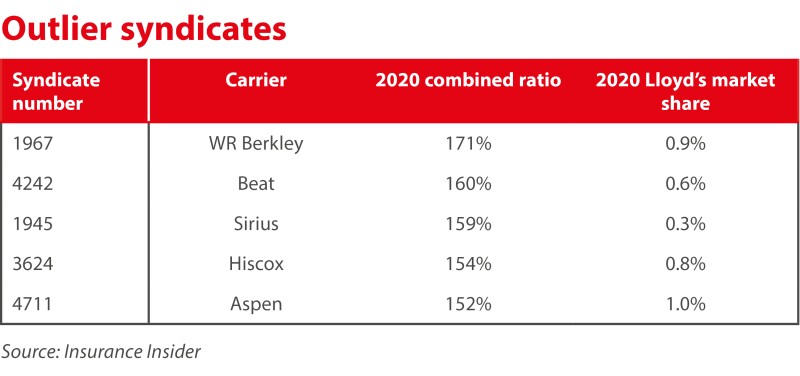

For the purposes of reader visibility, the above chart has been cut off at the 140% combined ratio mark, but those syndicates with GWP larger than £100mn and 2020 combined ratios of over 140% are outlined in the table below.

There is a received wisdom in the market that a syndicate will need a “critical mass” of around £500mn in order to drive down expenses and secure market relevance at Lloyd’s – equivalent to 1.4% of Lloyd’s 2020 GWP of £35.5bn.

The nature of Covid-19 losses and their asymmetric distribution across the market creates some noise in the 2020 numbers, however there are a number of syndicates with a market share greater than 1.4% which reported outsized underwriting losses compared to the Lloyd’s average, including Axa XL 2003, MS Amlin 2001 and Brit 2987.

Conversely there are a number of syndicates with a smaller market share which reported some of the best combined ratios in 2020 – including Probitas 1492, Channel 2015 and Ark 3902.

Many of the light touch syndicates – a proxy for best-in-class performance in Lloyd’s – have market shares of less than 2%, including Aegis 1225, Atrium 609, Lancashire 3010 and MAP 2791.

The outlier in this light-touch cohort is Beazley 2623, which has the largest market share in Lloyd’s at 5.8%.

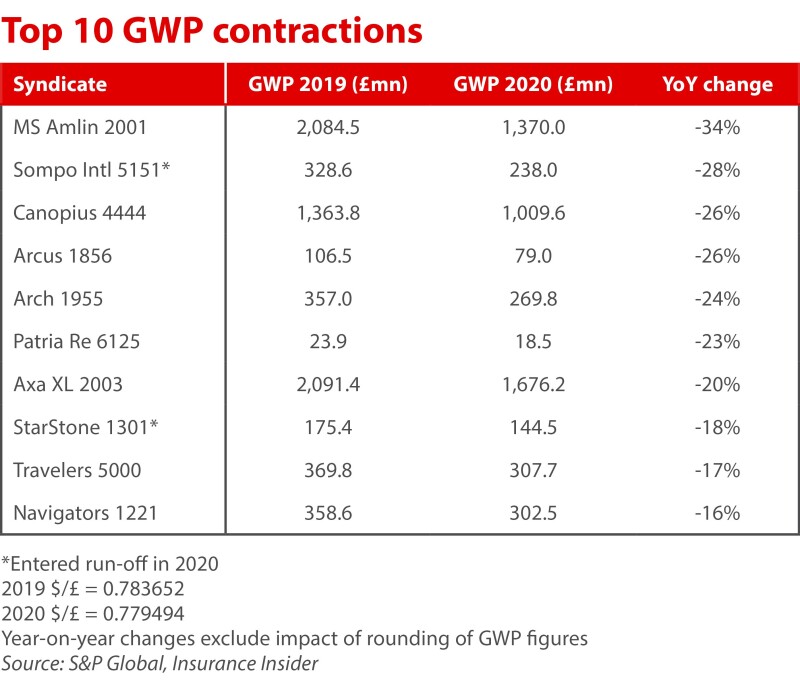

Meanwhile, since the 2019 analysis a number of larger syndicates have chosen to shed market share as part of remedial efforts.

In 2019, both Axa XL 2003 and MS Amlin 2001 held market shares of 5.6%, the largest in the market, but through the exit of classes and cull of poorly performing business have now dropped down the ranks with market shares of 4.6% and 3.8% respectively.

Both syndicates were in the top 10 premium contractions in 2020 as per our previous Lloyd’s syndicate GWP analysis.

After three years of tough remedial action at Lloyd’s, CEO John Neal has claimed the progress made on underlying performance means 2021 will be the first year in several that the Corporation will be in a position to permit growth in the aggregate.

However, this permission will only be granted to those who “earn” it, the CEO said.

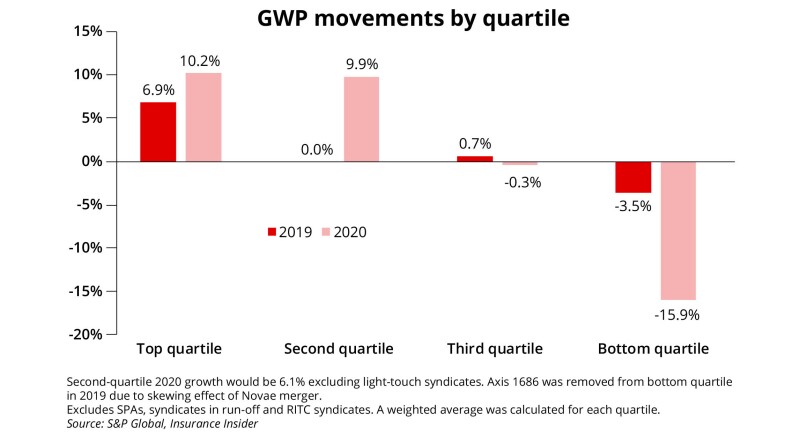

Previous analysis of 2020 syndicate accounts showed that the Corporation permitted an element of growth to a wider group than just the top performers of the market over the course of last year.

Analysis of the numbers showed a slight loosening of the restrictions on growth between 2019 and 2020, as the Corporation keeps a tight leash on market remediation.

However, none of the quartiles grew in excess of the 11% renewal rate change registered by Lloyd’s in 2020.