Aon

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

From 2026, the facility will also offer longer maximum construction periods.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

This publication revealed Jeroen van de Grampel and Nicholas Moore’s departures in August.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Rob Sage joined Aon in 2022 as an executive director.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The London-based pair will report to commercial risk UK CEO Rob Kemp.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

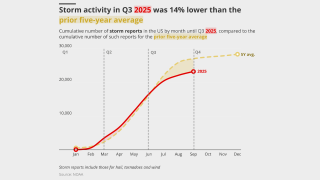

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The executive has worked at Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The platform aims to “bend the loss curve”.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Andrew Laing succeeds Rupert Moore, who will become reinsurance CEO for Asia Pacific.