Aon

-

The president and CEO will also be eligible for up to $50mn in shares.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

From 2026, the facility will also offer longer maximum construction periods.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

This publication revealed Jeroen van de Grampel and Nicholas Moore’s departures in August.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Rob Sage joined Aon in 2022 as an executive director.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

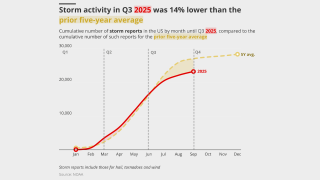

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The London-based pair will report to commercial risk UK CEO Rob Kemp.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The executive has worked at Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The platform aims to “bend the loss curve”.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

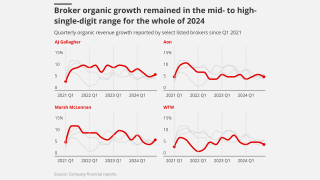

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Andrew Laing succeeds Rupert Moore, who will become reinsurance CEO for Asia Pacific.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The facility was previously for commercial risk clients.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Plus, the latest people moves and all the top news of the week.

-

The broker said the appointments are designed to drive growth.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

US events accounted for more than 90% of global insured losses.

-

Rates continue to drop as capacity is ample, the broker said.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker has expanded the number of global industry verticals to seven from four.

-

The broker noted a “significant variation” in renewal outcomes.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly the head of cyber solutions, North America.

-

The documents figure in a potential criminal case against a CCB employee.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until 1 September.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The executive will also continue as MD overseeing Caribbean fac.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

He was appointed executive chairman for international in 2021.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The executive was previously a top US casualty broker.

-

Ann Field, Matt Moore and David Griffiths have also had promotions.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insured losses were the second highest on record for the first quarter.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The 1 April renewals are the key date for Japanese treaty.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

Plus, the latest people moves and all the top news of the week.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

Eric Paire was head of capital advisory at Aon for nearly seven years.

-

The steep reduction in quantum stands to benefit specialty excess of loss reinsurers.

-

Sources said the claim is likely to be a multi-hundred-million-dollar event.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

-

Aon saw lower rates in reinsurance as capacity outstripped demand.

-

President Andersen said he was optimistic about the 2025 reinsurance market.

-

The broker introduced 2025 guidance for mid-single-digit or greater organic growth.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

The Moss Landing facility has previously faced major claims.

-

The associate director is exiting the broker’s product recall team after 10 years.

-

Aon is in hiring mode following the departure of several senior brokers to Howden Re.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

The Corporation’s CEO will run Aon Reinsurance Solutions.

-

The move means Lloyd’s will have a new chairman and a new CEO in the same year.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

In property, Canada, Central and Eastern Europe and UAE renewals were impacted by losses.

-

The executive said the market would soften during 2025 but would not drop through the floor.

-

The facility was launched in partnership with the EBRD.

-

Barry Stiff is expected to join Aon in May.

-

Jon Thacker has been at WTW for 20 years, specialising in construction.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

The commercial chief said Aon will avoid disrupting clients’ insurer relationships.

-

The executive is currently Asia Pacific CEO.

-

Cyber is more in the one- or two-year loss development camp, the Lloyd’s CUO said.

-

The Indonesian flag carrier moves during the busy Q4 airline renewals.

-

The long-serving Aon broker specialises in the placement of cruise portfolios and Norwegian accounts.

-

The executive has worked for LSM and Brit.

-

-

The global broker has beaten off competition from AJ Gallagher, and a number of other strategics.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Ball will succeed Jeff Poliseno, who is set to retire.

-

The broker said Europeans are pushing hard for rate or attachment point relief.

-

The broker expanded margins and grew earnings per share by 17% during the quarter.

-

The broker is discussing the potential for "smart frequency solutions" with reinsurers.

-

Continental cedants are looking for support for third and fourth events.

-

Underwriters are broadly pricing on the basis of a $1.5bn Baltimore claim, but there is uncertainty.

-

An estimated $6bn to $9bn will be ceded to the FHCF, and $6bn to $10bn to traditional reinsurance markets.

-

She most recently led the broker’s UK insurance vertical.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Richard Pennay will become CEO of Aon Securities.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Aon estimated losses for the Czech Republic at EUR775mn, Austria EUR555mn, Poland EUR285mn and Slovakia EUR33mn.

-

Padilla has also held senior regional roles at Cooper Gay and Swiss Re.

-

Better performance data and clarity around entry are key, report says.

-

The move follows the recent appointment of Aon’s Brad Melvin as US president and CEO.

-

The brokers called on the industry to “catalyse” the country’ growth by removing blanket exclusions.

-

Italy is seeking to address an insurance protection gap that is much higher than in other European countries.

-

The expanded team aims to increase capability across global specialty lines and property specialty retrocession.

-

The change comes as negotiations start to kick off for 2025 renewals.

-

The US carrier abandoned the project due to high price expectations.

-

Yen Chu Choo has been appointed Asia Pacific capital advisory head.

-

Rob Kemp leads the EMEA central broking team as strategic broking director.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Clients are taking advantage of market conditions to restore coverage limits.

-

Sources said LSM head of third party in Miami Humberto Pozo will serve as interim head of distribution.

-

The executive will end her career at Aon Bermuda effective 1 October.

-

-

This is a new role for the broker.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

Current head of marine hull Helen Costin is set to retire from the business.

-

He will focus on the London and US markets, including the placement of consortia and binders.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

President Eric Andersen said non-malicious cyber risk was “front of mind” for clients.

-

Organic growth was in line with WTW and Marsh McLennan, which both posted 6% underlying expansion.

-

The move comes amid elevated personnel movement in the energy sector.

-

Moore will oversee Aon Bermuda’s commercial risk solutions broking operations, leading a team of 85 executives.

-

The airlines, healthcare and financial services industries were some of the sectors affected by the outage.

-

The executive has worked for Aon, Steadfast and Argenta.

-

The figure is well above the historical average of $39bn for this century.

-

Trade, technology, weather and workforce were identified as the main mega trends.

-

The new hire spent two years as head of member services at Lloyd’s.

-

Farah Nelson will report to recently appointed group CFO Charlie Rozes.

-

A round-up of all the news you need today, including an updated forecast for Atlantic hurricane season.

-

Hurricane Beryl is expected to strengthen again after hitting the Yucatan Peninsula.

-

The executive was head of wholesale and specialty at Aon’s Global Broking Centre.

-

Paul Davies has been with the broker for more than 36 years.

-

Reinsurers were more willing to support lower layers ahead of 1 July, the broker said.

-

The facility will provide coverage globally for blue and green hydrogen projects.

-

The Mexican state oil company delivered the upstream market its largest claim in 2023.

-

The broker said US insurers purchased around $5bn of additional cat limit.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

Mark Parker has been leading the GBC on an interim basis and will retire in the coming weeks.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

Interest is growing in third-party capital, captives and private debt.

-

Dan Walsh has led Aon Client Treaty for the past six years.

-

The $357mn programme consists of four transactions, including a $50mn facility brokered by Aon.

-

The broker has more than 30 years’ experience in the London motor market.

-

-

-

The broker noted a shift towards alternative risk solutions in the MENA region.

-

An EF-4 tornado devastated Greenfield Iowa, adding to the expected multi-billion-dollar toll.

-

The most common breach type was law compliance, followed by financial statements.

-

He will report to Cynthia Beveridge, global chief broking officer for commercial risk.

-

He will report to Kelly Superczynski, Aon’s global head of capital advisory.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

Aon’s CEO said the business was formerly “very underweight” in the middle market.

-

The broker announced yesterday it had completed its $13bn acquisition of NFP.

-

James Platt has previously held group COO and chief digital officer roles at Aon.

-

The most extensive damage was caused by rainfall in Texas, Louisiana, Mississippi and Florida.

-

Eric Paire has been at Aon since 2018, having joined from Guy Carpenter.

-

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

Sources cited numerous issues with how collateral protection insurance was designed.

-

Natural-cat-exposed business saw significant price increases.

-

The pair hail from Miller and Aon respectively.

-

The exit follows the broker moving its Climate Risk Advisory function into its Risk Capital segment this year.

-

He was executive managing director in Aon’s wholesale treaty team.

-

Mike Smith will step down from his role on 31 March.

-

The end of the waiting period effectively clears the path to close in the US.

-

-

The executive will lead strategic initiatives and hire talent.

-

The broker has been adding to its capabilities in the region.